Take a Personal Finance Class at Home: Watch David Bach and Become an Automatic Millionaire

Money helps you Be.

Money helps you Do.

Money helps you Have.

This post contains affiliate links. See Disclosures for details.

Alright, so I just finished binge watching David Bach's class Start Late, Finish Rich on CreativeLive. If you are not familiar with CreativeLive, they produce and create workshops to inspire and support people with the tools to develop their creative skills. They have a community of amazing and talented people teaching others how to making a living out of their creative passions. If you are not familiar with David Bach, he has written nine consecutive New York Times bestsellers and was a regular on Oprah and so many other media channels and is a trusted financial expert. So when I saw that he had a class up on CreativeLive, I jumped at the chance to take it. I have to be honest, I was in between him or Ramit Sethi, but I feel like David Bach provides a lot of good foundational knowledge.

Full Disclosure: I am a CreativeLive affiliate and was provided the opportunity to take a class for free. Of all the classes available on CreativeLive, I chose this one and have no regrets.

Who Is The Class For

I believe this class if for everyone. That's a lot to say. I have been a David Bach fan since I've read his books, The Automatic Millionaire and Go Green, Live Rich, seeing him talk and visually explain all of the concepts from his books is amazing. This is a class I would recommend binge watching with your partner. Instead of watching the next Netflix show, watch this instead. Sit down, takes notes and take action. I'm fairly familiar with all of the topics he talks about, I mean I have a site dedicated to personal finance, but seeing him explain this is so worth it. If you have read his books or any books in the personal finance realm, a lot will be repetitive, but there will be key nuggets of information that you will still learn.

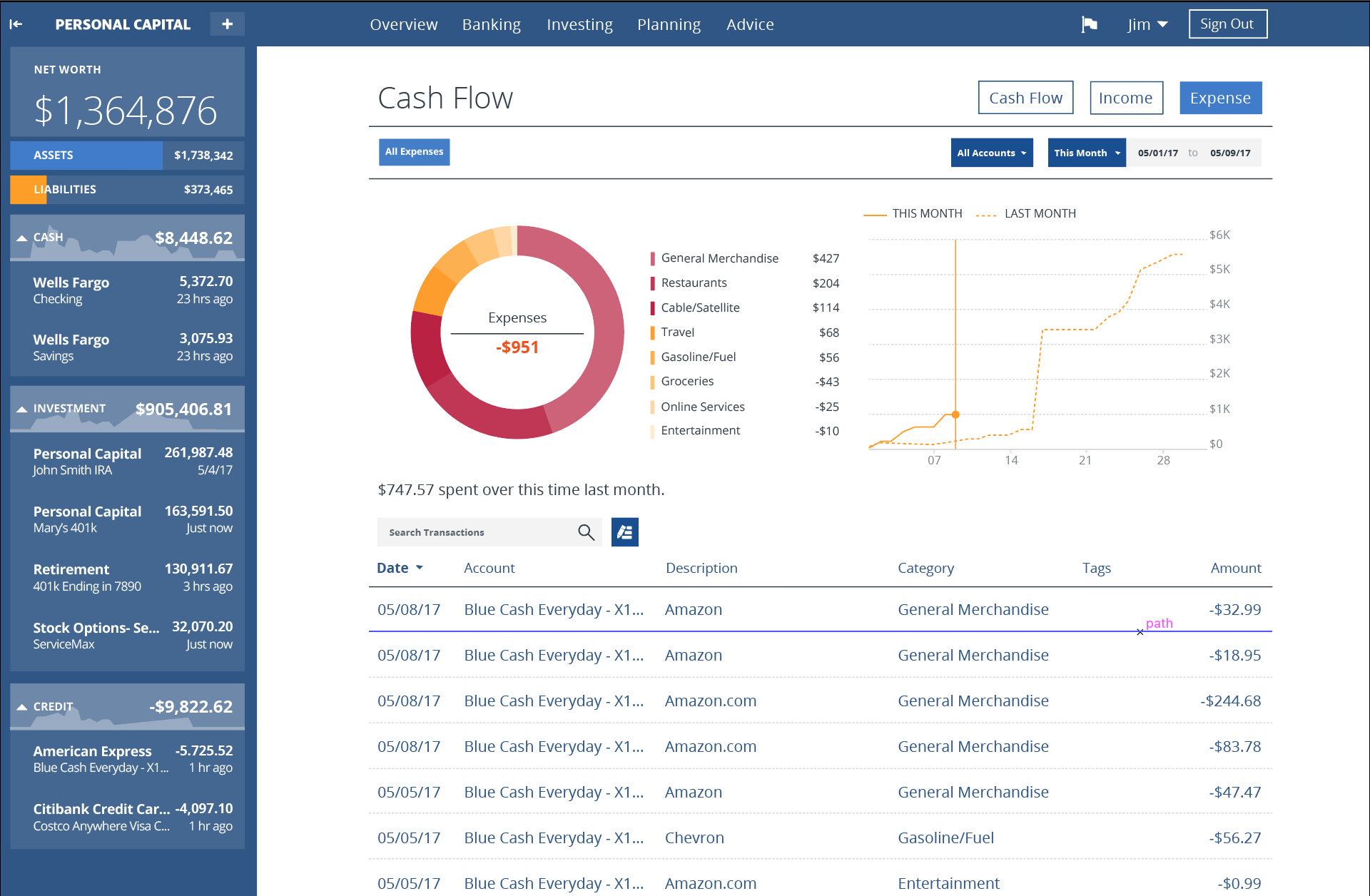

For a price of $127 (as of this writing), you get to sit in on David's class and learn how to save money and invest. If you are new to personal finance and just starting out, I think this is one of the best investments you can make today. There's going to be a trade off of time, money and information and if you watch this, you will be sacrificing time and money, but I believe the return will be so much greater in the long-term. If you do one of the things he tells you to do, that $127 will pay itself off in a month or two. The alternative of course is to read all of his books or browse the web for similar FREE information.

The Class Breakdown

The class itself is around 6 hours broken up into 19 lessons. He covers the basics, but more importantly introduces concepts that are not taught in the traditional school system about money, savings and investment. He has a very straight forward approach to the way he presents information. There are visuals in the video itself as well as PDF handouts and worksheets that you can use to follow along.

As a tip, because I am familiar with the content, I find that he can speak a little slow sometimes so I watched the videos at 1.5x speed so it went a little faster for me.

With a minor technical glitch on the 3 days that I binge watched his class, I was able to view the class on my both desktop and the mobile app without any issues.

Here's a sneak peek of of one of the lessons from the class: Crush Your Debt.

Three Concepts Worth Noting

Of course, I don't want to steal the thunder from the class, but I will highlight 3 concepts that tie in to Sisters for Financial Independence.

Pay For Yourself First

David Bach - Pay Yourself First Graphic

He harps on this often. What does this mean? Basically, he breaks down a typical work day. Starting from 9am-12pm, we work just to pay government taxes, from 12pm-2pm, we work to pay our rent or mortgage, from 2pm-3pm, we work to pay transportation costs, from 3pm-4:45pm, we work to pay for our bills, activities, healthcare, etc. and from 4:45pm to 5pm, we save the rest. It's not a lot in the end so what he and other personal financial advisors will tell you is to Pay Yourself First. Before the government even touches your hard earned earnings, move that money pre-tax to a 401K, IRA or other retirement vehicle. Doing so in the end usually means you won't have enough.

Make It Automatic

This is critical too. If you've ever read the history of taxes in the United States, there's an important lesson in there. The government knew that most people would not pay their taxes if it was taken out after the fact so instead the government made tax deduction from paychecks automatic. Similarly, if you've noticed a rise in subscription services, you will also notice that they have taken this similar automatic deduction concept to pull money from you. In this case, we have to make automatic work for us instead of the government or other business. Our audience is fairly young so there should no be an excuse that you don't have access to technology to automate your finances. If you make that excuse, I call B.S.

I've linked his YouTube video on how to make this Automatic as a teaser for you. The class offers so much more.

Re-Think Retirement

Many of us, especially those in the early 20s or 30s think retirement is so far away, but David Bach makes a good point that retirement is not about just ending work, but it's about the opportunity to Re-Invent, Re-Engage, Rejuvenate, Re-Center and Re-Ignite yourself. Chances are, you are not going to want to do something for over 20 years, unless of course you really love it, but that's rare nowadays. Without pensions, we are not destined to be at the same company. Retirement doesn't have to happen because of age, it can happen because of income and that is what we in the FIRE community are striving for. Another point too if you are reading this in your 40's or 50's, it's never too late. We may live to be 80, 90 or 100 years old, there's still opportunity to make money in the decades ahead.

In Conclusion

So of course, the personal finance geek that I am would totally recommend this class. If you are new to the FIRE community, this will be a great foundation. If you are experienced, I think there is a lot still to be learned especially as we ebb and flow towards varying life experiences and we may not have paid attention to certain concepts because it wasn't relatable just yet.

If you know someone who could use this knowledge, consider gifting it to them. $127 (as of this writing) seems a lot, but it's a month's worth of lattes, a few six packs or a dinner for 2 people. Sacrifice something and get yourself to started.

One last thing, because I want to provide resources for you, if you can't cut the $127, check out his YouTube channel and his books. His channel still has a lot of good content, but won't be as comprehensive as the class or if you read ALL of this books. I'm a visual person so watching him explain concepts in video helps me retain ideas faster.

If you take the class, please let me know how you like it.

If you know these concepts already, please tell me why you have kept it to yourself, because there's someone out there who continues to struggle financially and the least you can do is share them this information.

Take a Personal Finance Class at Home: Watch David Bach and Become an Automatic Millionaire