Negotiation skills are crucial in various aspects of life, including parenting. Whether you're trying to convince your toddler to eat their vegetables or discussing important decisions in the workplace, effective negotiation can make a significant difference in getting effective results. In this blog post, we will explore the importance of good negotiation skills for parents and highlight the top five negotiation books to help you become a master negotiator. Additionally, we'll provide you with valuable tips for negotiating with both toddlers and business counterparts.

All in Financial Books

14 Best Books for Teach Kids About Money

Talking about money can be hard. These books can help you teach money to your toddlers and teens.

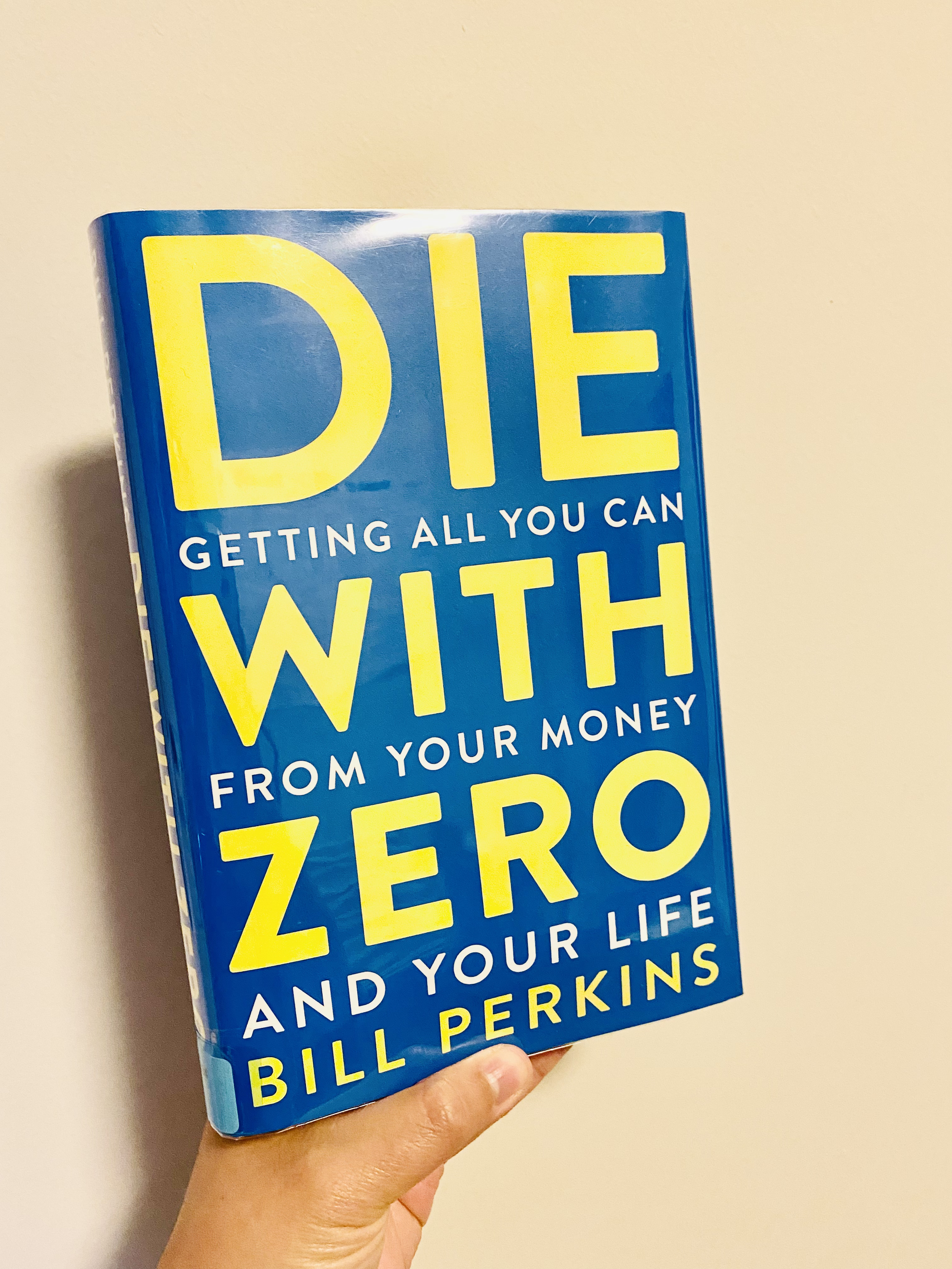

Die with Zero by Bill Perkins: Book Summary and Review

This month’s book is called Die With Zero: Getting All You Can From Your Money and Your Life by Bill Perkins. In short, the book is a personal finance book, but it doesn’t talk about saving, budgeting or investing like the majority of personal finance books though. This book instead talks about using your money intentionally to fund and find fulfillment.

Book Review and Summary: The Debt Trap by Josh Mitchell

This month’s book is The Debt Trap: How Student Loans Became a National Catastrophe by Josh Mitchell. It was written by a reporter from the Wall Street Journal who has years of experience writing about the economy and higher education.

The book covers the history of student loans and the creation of the college industrial complex. I didn’t know much about how the idea of student loans came about so the book was an insightful look at the players that eventually created a big business that impacted most of our lives.

Book Summary: The Color of Money - Black Banks and the Racial Wealth Gap by Mehrsa Baradaran

“...the currency of the South was the slave”

This month’s book is “The Color of Money - Black Banks and the Racial Wealth Gap” by Mehrsa Baradaran. It covers the history of Black banking and the role of racism in the economic independence of the Black community.

Today, on every socioeconomic level, Blacks have significantly less wealth than whites. The book explains how the racial wealth gap was created that continues to affect millions of families in the United States. There were also many laws and policies like the GI Bill, the Homestead Act and the FHA that denied the Black community the opportunity to advance and economically prosper.

Book Review and Summary: Tales of Horror and Happiness in Hospitality

HOSPITALITY, n. The virtue which induces us to feed and lodge certain persons who are not in need of food and lodging.

This month’s financial book is a bit different than past books. The book is titled: Tales of Horror and Happiness in Hospitality by Dr. Kiona and Maria Gangat. You can find it on Amazon (linked) or check out her Instagram story highlights for more info.

This book covers two prevailing concepts that’s heavily discussed in the financial independence, retire early (FI/RE) community: house hacking and geoarbitrage so it fits in nicely here.

Book Review and Summary: The Do Gooder's Guide to Investing by Adrian Reif

“It turns out you can give your money to a project positively impacting the world with the goal of earning a financial return.

Can you grow your money while investing in positive change for people and the planet? I believe that we can and this book The Do Gooder’s Guide to Investing by Adrian Reif provides a roadmap on how we can do all that.

The word “investing” can sometimes get a bad rap because it’s associated with Wall Street, but it’s absolutely possible to invest in affordable housing, renewable energy and local communities and still grow your money. The Do-Gooder’s Guide to Investing provides a comprehensive list of these investing options. Even if you are not ready to invest yet in these organizations, I highly recommend reviewing and learning more about the organizations that Adrian lists as it will give you some hope about the future.

Book Review and Summary: Women & Money by Suze Orman

Put a value on what you do and do not let anyone to undervalue you."

The last book of the year in the Book of the Month Series is Suze Orman’s Women and Money: Be Strong, Be Smart, Be Secure. I’m a fan of Suze Orman. It was her book Young, Fabulous and Broke that actually started my FI journey many years before FI was even a term for the mainstream.

The first version of this book was published back in 2007. I remember reading it, but at that point in time, I was in a completely different mindset and I glossed over most of the topics. Fast forward to 2019 and I now see many of the topics having some relevance in my life.

Book Review and Summary: The Dumb Things Smart People Do With Their Money

This month’s book is The Dumb Things Smart People Do With Their Money by Jill Schlesinger. Each chapter of the book is a topic on the dumb things smart people do with their topic. I appreciate the book for the straightforward way the author described the Dumb Things. The topics are all worth reviewing and revisiting. It’s especially important if you are busy building wealth or hitting that FI number that there’s other things we all need to look at to protect our wealth and the security of our loved ones.

Book Review and Summary: It's the Student, Not the College by Kristin White

"No man should escape our universities without knowing how little he knows."

This month’s book is all about college since October is FAFSA month. This book, It’s the Student, Not the College, by Kristin M. White, an educational consultant is a well-thought out book on the realities of college, of the college admission process, the future of college and what students should do in order to fully become successful in college and all future endeavors. I’ll break down a few of the sections to give you a sense of what’s in it, but for $10, this book will probably be the best investment you will make for yourself and your child.

Elizabeth Warren, The Two-Income Trap and the Pursuit of Financial Independence

This post is part of the #MommyMoney Series. A series that explores money, motherhood and financial independence. The Two-Income Trap: Why Middle-Class Parents Are (Still) Going Broke is written by Elizabeth Warren with her daughter, Amelia Warren Tyagi. This month’s book is not your typical personal finance book. It doesn’t espouse the same list of recommendations on how to save, what accounts to open, etc. Instead, it is a well researched book about the American family, its American dream and challenges of being middle class in the current financial and government system.

Book Review & Notes: Out of the Rat Race By Eric Duneau

“Keep your focus. You are planning your financial independence. You are in a different game. Don’t be jealous of their fancy stuff.”

Book Review & Notes: Out of the Rat Race By Eric Duneau is the story of his journey to reach financial independence. It covers everything from the history of money, real-estate investing, the importance of human capital, attitude and how to leverage it all for financial freedom.

Book Review & Notes: Women With Money by Jean Chatzky

Women are very clear about what we want from our money. We want to satisfy our needs for safety and security.

This month’s book is Women with Money: The Judgement Free Guide to Creating the Joyful, Less Stressed, Purposeful (and Yes, Rich) Life You Deserve by Jean Chatzky.

Book Review & Notes: Broke Millennial - Get Your Financial Life Together

You, right now, have a choice: you can let money control and define your life or you can control it. - Erin Lowry, Broke Millennial

This month’s book is Broke Millennial by Erin Lowry. You can read more about Erin on her blog, brokemillenial.com.

The title of the book can peg it as a book specifically for Millennials, but I disagree and encourage you to pick it up if you are looking to up your financial knowledge no matter what age you are. It’s not a book on investing or retirement, which I think makes it better. It’s a comprehensive on the basics of money mindset, credit, student loans and debt. The content in this book provides a good foundation for better money management and eventual wealth creation.

That Payment Free Feeling: We Just Paid Off Our Car

And it all began with one small win.

This is a celebratory post. Back in 2014, my husband and I decided to purchase and finance a brand new vehicle, a Subaru Outback. Today, we just sent in our final payment and are now reeling in that monthly payment free feeling. No more monthly outlay. ::dance::dance::

Book Review & Notes: The Power of Zero - How to Get To the 0% Tax Bracket

Social Security was never intended to be a retirement program. It was merely insurance against living too long.

This month’s book review and notes are from The Power of Zero - How to Get To the 0% Tax Bracket and Transform Your Retirement. Learn more about David McKnight over davidmcknight.com and listen to his podcast via YouTube. Fitting since we are just about to close out tax season. Perhaps, the lessons in this book will change the way you manage your money to be more tax efficient now and always.

Book Summary: The Little Book of Common Sense Investing

“The two greatest enemies of the equity fund investor are expenses and emotions.”

In honor of the passing of John C. Bogle, found of Vanguard and father of index funds, I picked up the updated edition of his book “The Little Book of Common Sense Investing.” I’ve heard of this book before, but never got around to picking it up. It’s a worthwhile book to read especially for those new to investing or those that need a refresher on the value of investing.

Book Review & Notes: Financial Freedom by Grant Sabatier of Millennial Money

When the opportunity to sign-up to preview Grant Sabatier’s new book Financial Freedom: A Proven Path to All the Money You Will Ever Need came up, I jumped at the chance and am so glad I did. It is jam packed with actionable insights. More importantly, it gives you a blueprint of how to achieve Financial Independence early on. There’s also an important question that Grant addresses “Why do you want to retire early?” Retirement while your fully financial independent is all about options and its all about choices.

Book Notes: Financially Stupid People Are Everywhere (4 Rules to Follow to Be Financially Smart)

“They sit mesmerized before advertising campaigns telling them to buy trifles they don’t need using debt they can’t repay.”

In “Financially Stupid People are Everywhere: Don’t Be One of Them,” Jason Kelly opens your eyes to the debt driven world we live in and what you’re up against in society. He posits the only way to truly safeguard your own well being is to look after yourself. Provide security and ensure your freedom by following the 4 financial rules that will keep you from being financially stupid.

The Four Tendencies and Personal Finance: How to Motivate Yourself to Take Action Towards Financial Independence

“It’s been freeing to focus on what works for me rather than what’s wrong with me.”

I just recently finished reading Gretchen Rubin’s The Four Tendencies. In the Four Tendencies, Gretchen Rubin, outlines four different personality types based on how each one deals with inner and outer expectations: Upholder, Obliger, Questioner and Rebel. By understanding our Tendency, we can harness that to find our own internal and external motivations.