Banking for Good: Get Your Money To Do More Good

"There is no power for change greater than a community discovering what it cares about."

As part of our Socially Conscious FI Series, today we are exploring minority owned banks. The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that provide deposit insurance to depositors in U.S. depository institutions. Basically, in case of a bank failure, the FDIC covers deposits up to $250,000, per FDIC-insured bank, for each account ownership category. This means your money is safe as long as the bank is FDIC insured. All of the big banks are FDIC insured and you can verify this by going to your bank’s website, scrolling all the way down to find the disclosure information.

Along with the insurance, the FDIC also supports and tracks a list of the insured Minority Depository Institutions (MDIs) it supervises. The definition of MDI is in the next section.

I had originally written this post for informational purposes, but as I was ready to publish it, news of another death of an African American in the hands of a white police office came out. This is now a call to action. It’s important that we pursue financial independence with our values in mind. It is imperative that we not only think about our own future, but the future of the communities that we are a part of as well as the cultural backgrounds we come from.

I read this phrase somewhere in my research: “organized money is power” and it keeps ringing in my ear. Let’s think about this phrase for a second. When I first started learning about personal finance, the lack of knowledge, lack of savings and debt made me feel powerless for some time. It wasn’t until I made the conscious choice to get out of debt and save money that I started to gain confidence and power to make choices and choose opportunities that provided me greater benefits. In the context of the larger overall system, money is where power lies. We currently live in a money-based system and I honestly don’t foresee that changing in the near future. So it is up to us to shift and distribute money equally so that “power” can be distributed equitably across all communities.

This post contains affiliate links. See Disclosures for details.

A Brief History on Minority Depository Institutions

First, a disclaimer that I am not an expert on the history of banking in the United States, especially, the history of banking for minorities. There are some amazing articles and books out there that talk about the challenges of minority banks. Partnership for Progress, a program to preserve and promote Minority Depository Institutions (MDIs) from the Board of Governors of the Federal Reserve System has a timeline of minority banking in the US as well as other resources to help smaller, minority banks thrive in the competitive economic landscape of the banking industry. With that said, minority banking continues to have it’s own challenges today, but it’s also time that we begin supporting these institutions so that they continue to thrive over the long-term which helps our communities even more.

I would encourage you to read this article as well as this book, The Color of Money (notes here), which tells an untold history of black banking in America.

Here’s some background on the FIRREA Act that helped establish Minority Depository Institutions (MDIs).

Back in August 1989, Congress enacted the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 ("FIRREA"). Section 308 of FIRREA established the following goals:

• Preserve the number of minority depository institutions;

• Preserve the minority character in cases of merger or acquisition;

• Provide technical assistance to prevent insolvency of institutions not now insolvent;

• Promote and encourage creation of new minority depository institutions; and

• Provide for training, technical assistance, and educational programs.

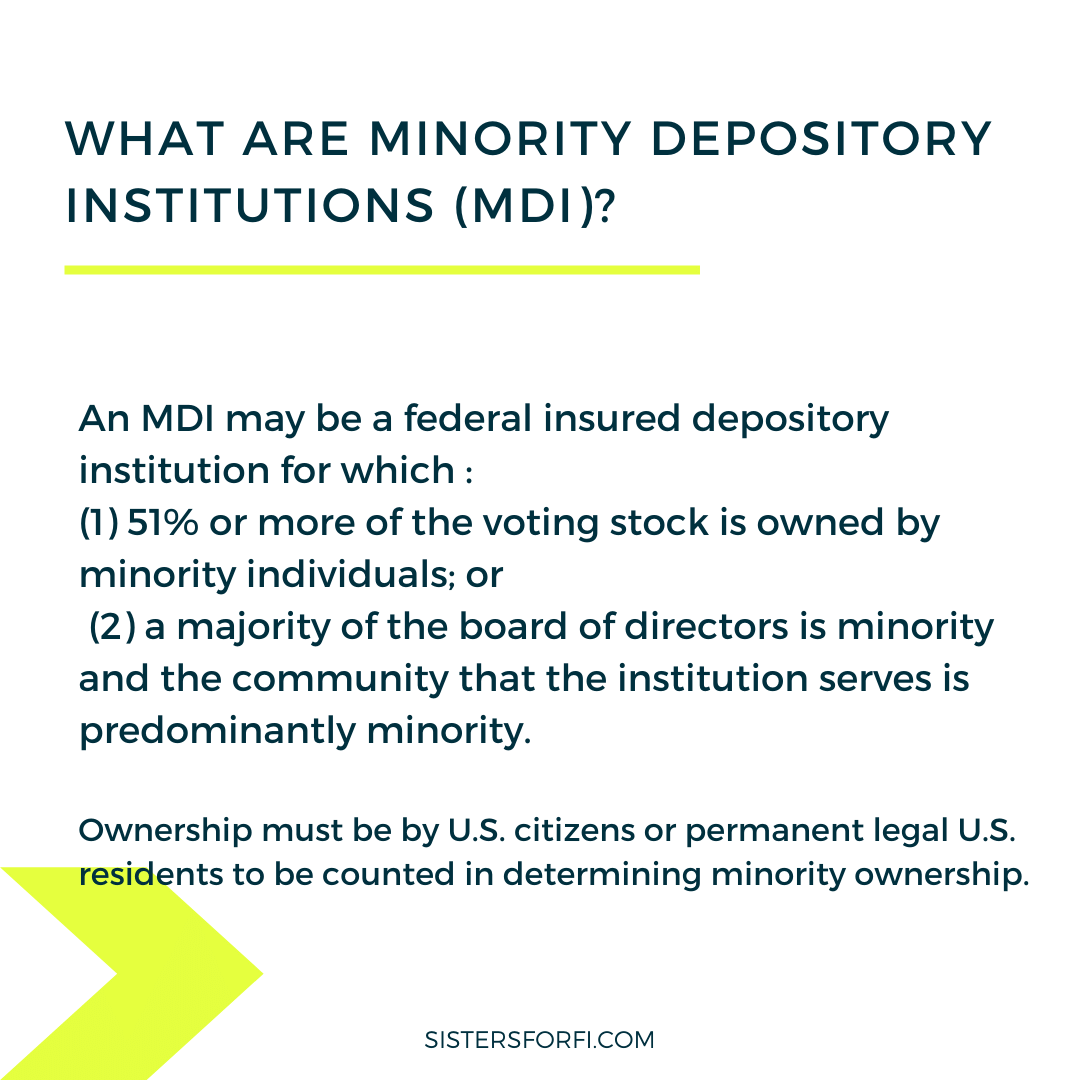

"Minority" as defined by Section 308 of FIRREA means any "Black American, Asian American, Hispanic American, or Native American." Section 308 of FIRREA defines "minority depository institution" as any Federally insured depository institution where 51 percent or more of the voting stock is owned by one or more "socially and economically disadvantaged individuals." Given the ambiguous nature of the phrase "socially and economically disadvantaged individuals," for the purposes of this Policy Statement, minority depository institution is defined as any Federally insured depository institution where 51 percent or more of the voting stock is owned by minority individuals. This includes institutions collectively owned by a group of minority individuals, such as a Native American Tribe. Ownership must be by U.S. citizens or permanent legal U.S. residents to be counted in determining minority ownership. In addition to the institutions that meet the ownership test, for the purposes of this Policy Statement, institutions will be considered minority depository institutions if a majority of the Board of Directors is minority and the community that the institution serves is predominantly minority.

Source (FDIC.gov)

As of 12/31/2019, there are 144 MDIs with a total of $248 billion in assets. Compare that to JP Morgan Chase total assets of $2.687 trillion (2019). As of 2019, around 33 have assets over $1 billion. Source: FDIC.gov. MDIs promote the economic viability of minority and under-served communities by offering financial literacy, second chance banking and lots of other resources that help circulate the money within the community.

Should You Bank With a Minority Bank

Should you move your money to a bank primarily owned by minorities? Yes, I think there’s value in in it. I think there are some advantages to banking with a minority bank as it helps support and promote institutions that give back to under-served communities that are left out of the mainstream banking system. A lot of these MDIs are fairly small so they don’t necessarily have the marketing and advertising budget to reach the masses. Minority banks have a median age of around 34 years so many haven’t been around that long to capitalize on their name and their own growth.

As of the end of 2019, nearly half of the MDIs were designated as serving the Asian American community. East West Bank is the largest of these minority institutions. It was founded in 1973 to serve mainly the Chinese American community in Southern California. Banco Popular de Puerto Rico is the second largest MDI in assets. OneUnited Bank is the largest MDI in assets owned by African Americans and Gateway First Bank is the largest MDI in assets owned by Native Americans. Check the list of MDIs here. You can also check out Juntos Avanzamos Credit Union and Native American Bank for other options.

It’s important to know that these kinds of banks exist especially as we challenge the status quo for a more equitable chance at wealth creation and growth for all. Many minority groups have been sidelined from organizing their money because organizing money meant power and many groups did not want to see minorities with power.

As with anything, it’s important to research financial institutions that you will be working with, after all, your hard earned money is going to be there. Majority of the MDIs, while small, have the same resources you’d come to expect from a bank in the year 2020. This means online and mobile banking, bill pay and remote deposit. Carefully read through their services though and the fees they offer to see if they fit your needs. It’s OK to shop around for banks. Gone are the days where your only bank option is the one in town.

If you are minority and have had trouble opening an account with a mainstream bank like the Chase and Wells Fargo of the world, consider finding a minority institution to bank with. Many, such as, OneUnited, the country’s largest black-owned bank by assets, offers second-chance checking for customers who’ve been denied an account in the past. OneUnited is also part of the #BankBlack movement and offers referral rewards for new customers.

The Reality

Here’s the reality and the challenge too. It’s hard for these small institutions to get bigger and help more people because historically they serve a community with higher rates of poverty and depressed housing values which lead to unprofitably. It becomes this unfair cycle. So a solution would be to move money away from the mainstream banks and into these banks that serve specific communities. It’s more important now that we support these smaller banks as the current financial crisis will strain their livelihood.

“If you’re a white ally of Black Lives Matter or any person who thinks it’s wrong that black people in America are still facing some of the issues that Martin Luther King was facing in the 1960s,” he said, “then put your money where your mouth is.”

Next Steps

Consider moving a percentage of your money towards a minority banking institution as a start. Check out the listing of Minority Depository Institutions here. Filter based on Minority Status and then check the bank through this third party Deposit Accounts.

You can also check out Juntos Avanzamos Credit Union and Native American Bank for other options.

GreenAmerica’s has provided 10 Steps to Breaking Up With Your Mega Bank.

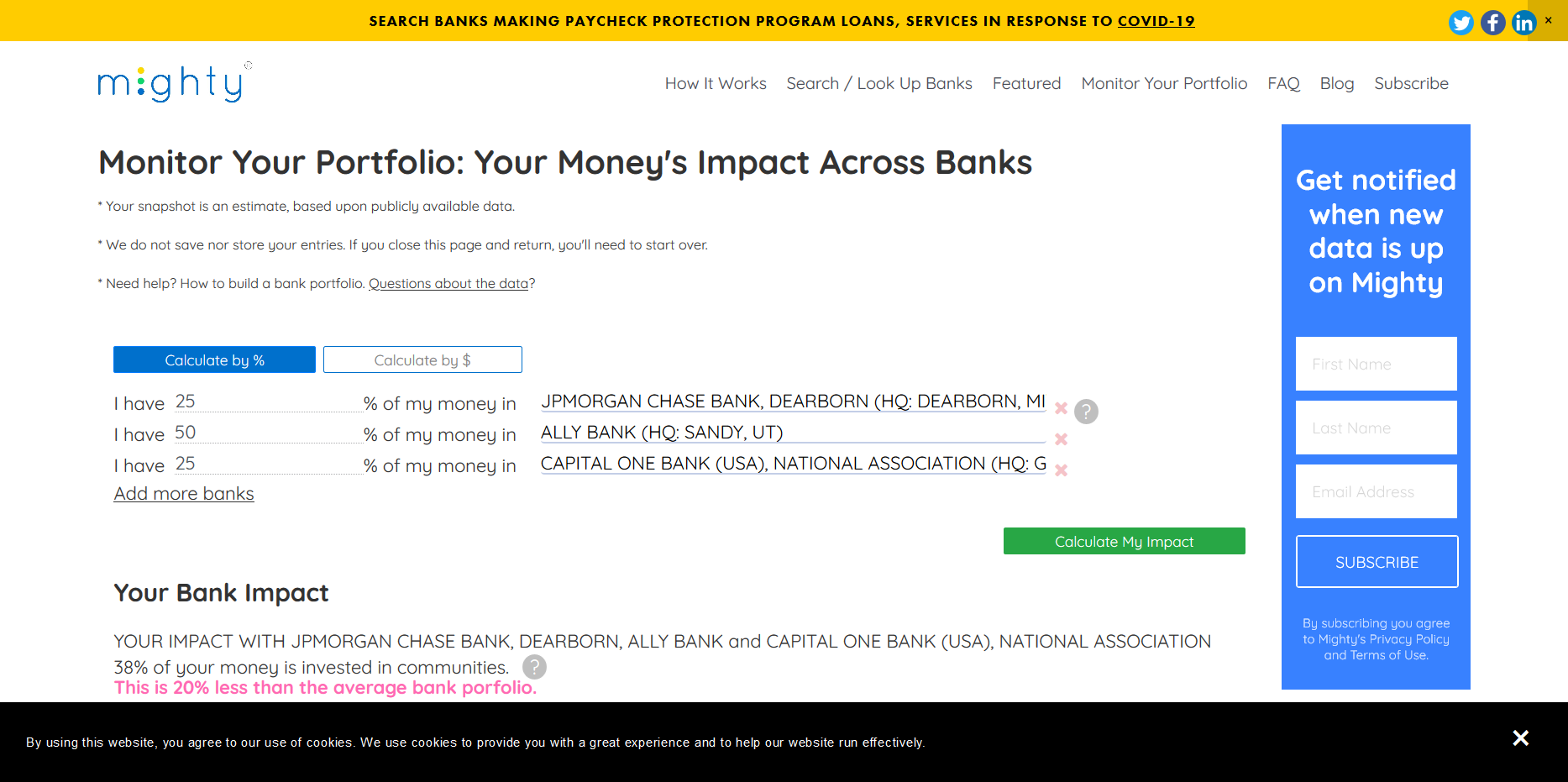

You can also head to MightDeposits.com to search banks according to the economic, social, and/or eco impact you want. Mighty Deposits has a tool that rates the impact of your banking. I included a sample bank portfolio below. This one has Chase (we don’t bank with Chase), but based on the results, only 38% of the money is going towards the community so so shifting a percentage of money away from Chase could be the next step.

Laura of Rich and Resilient wrote a blog post on this topic too and she shares a lot of other resources so check that out as well. She’s been a guest here at Sisters for FI. Read her post “An Environmentally and Socially Conscious Path to FI.”

I hope that as we all continue our quest for financial independence that we help others along the way.

Mighty Deposits: Result of the impact of our money across banks

Banking for Good: Get Your Money To Do More Good

Photo by Erol Ahmed on Unsplash