Track Your Finances For Free With Personal Capital And Get to FI Faster

This post contains affiliate links. See Disclosures for details.

There are these billboards on the highway close to where we live that says we spend more time doing x, than planning for retirement. This sounds scary to me. I will also be the first to admit that sometimes I get lost on social media. I've learned to strike a balance though by using a financial app that's as easy to use and as aesthetically pleasing as the feeds I see on Instagram. When it comes to financial apps out there, there is no shortage of tools that one can use, but after using Personal Capital for almost two years now, I would highly recommend it to anyone wanting a high level overview of their finances. While Personal Capital is an account aggregator, it has so many other tools that make it worthwhile to use especially at the price of FREE. Well, right now, it is free, however, they do have wealth management services that they will sell you on. I don't use their financial services, but honestly, I would pay to use the aggregator service and the analytics that come with it.

There are many personal finance apps in the market that offer you a wide range of features including expense tracking, budgeting, investing, investment review, portfolio tracking, net worth tracking. The advantages to using these apps is that you can basically check how your finances are doing with one swipe. It helps if you are looking to see trends and it's just sometimes comforting to see that you are on the right path. You'll have to do the initial syncing of accounts, but it saves you from having to log into individual accounts which can be very time consuming. I know for a lot of us, time can be a barrier so doing this once will be a lifesaver. There's no longer an excuse for not knowing the health of your finances.

I, personally, use Personal Capital in a few ways.

Track Net Worth

I like to track my net worth because it reveals the true nature of my bank balance. It helps me to understand what I own (assets) and what I owe (liabilities). Personal Capital does a great job showing your net worth over time.

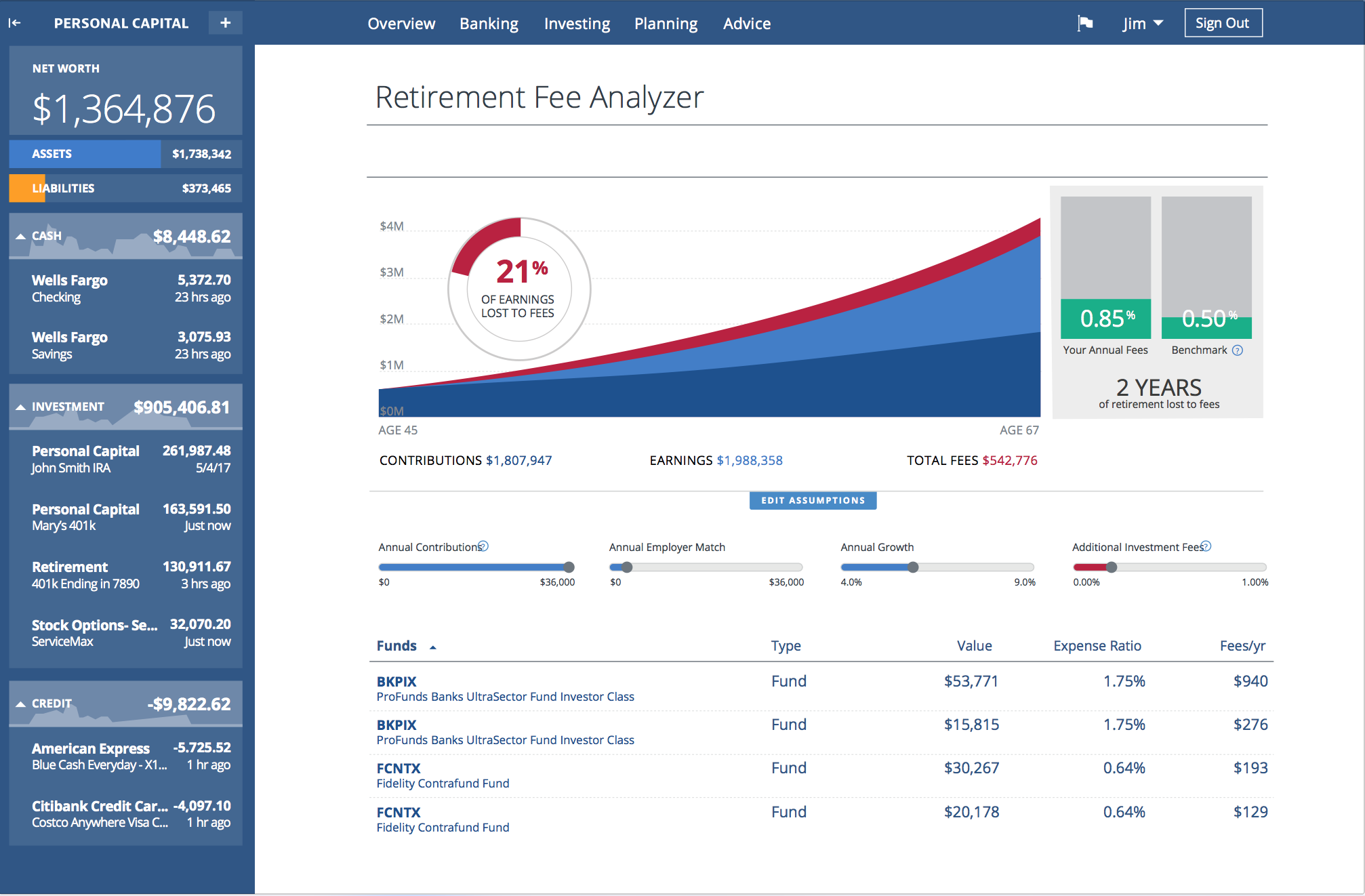

Track Fees

This is important. Most investments never net a profit because it's bogged down by fees. Imagine investing a few thousand dollars. After a few years, you see it grow and the price rise. You try to calculate what you will earn if you sell it, but surprise, surprise, the profit has actually been eaten up by management and transaction fees. The horror! Think this isn't happening to you? Think again! Many of the mutual funds and ETFs that you are investing in are loaded with fees. Because I myself have a few accounts, I like this aggregate look into the state of things and perhaps which investments I need to change that has a lower expense ratio.

(P.S. This is not my account balance. Just a stock screenshot.)

Get an Overview of Expenses

We don't have a household budget to be honest, but I do track our expenses and being able to quickly see where we are across a variety of cards is helpful. My husband and I maximize the use of points via our credit cards so we do have a few in rotation and Personal Capital helps me to do that. This is similar to Mint's features, but because this is not the only thing that Personal Capital does, I have found Personal Capital to just be more advantageous.

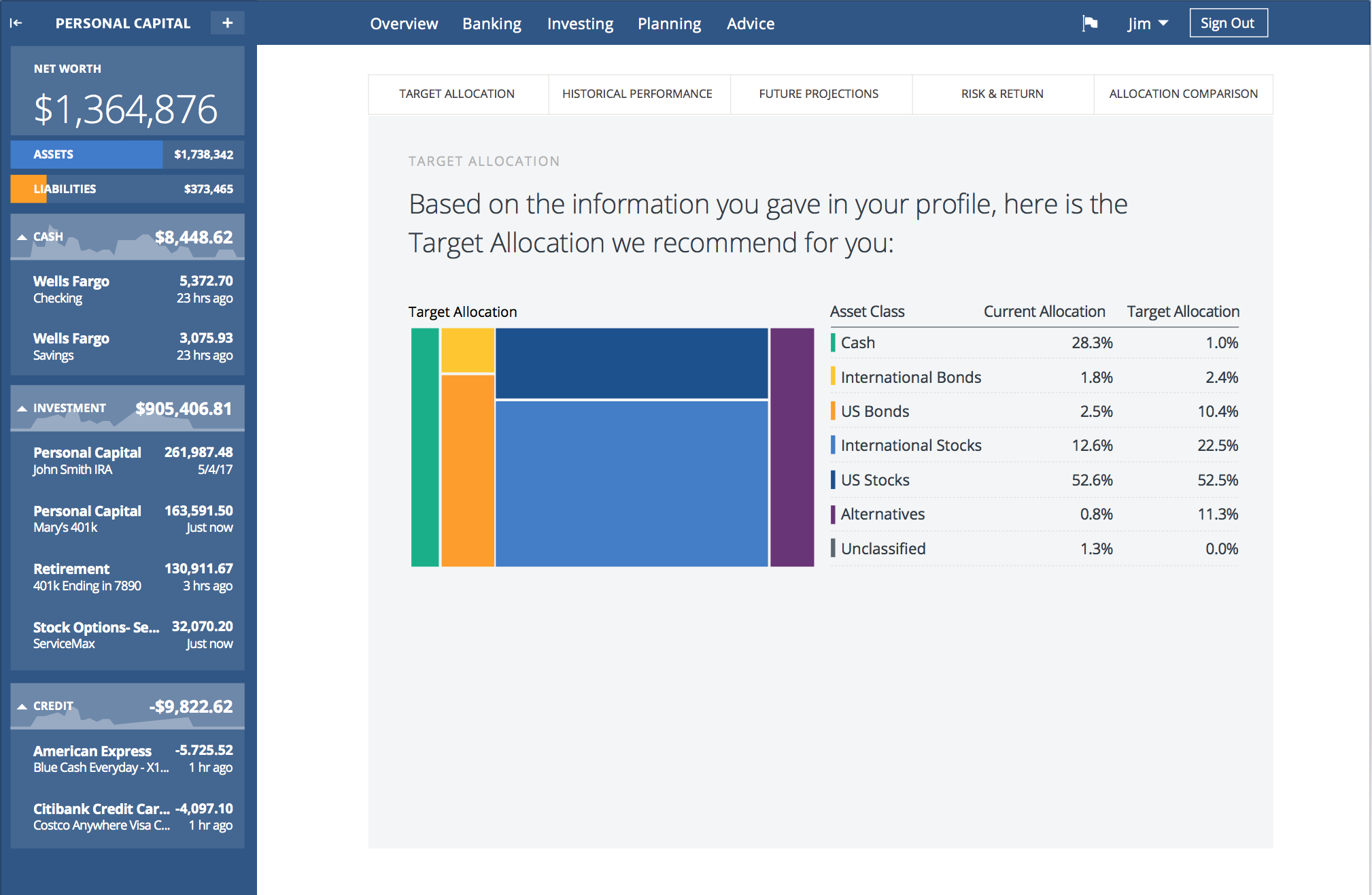

Track Asset Allocation

Because I have a retirement, IRA and brokerage accounts and my husband has his own, I like one of the reports that Personal Capital provides which gives a snapshot of where investments are allocated. Are we diversified enough or do we have all of our eggs in one particular basket? If I was to do this manually, I would have to extract all reports from my accounts + my husbands, categorize it and figure out the percentages. With this, it's one swipe on the app.

(P.S. This is not my allocation. Just a stock screenshot.)

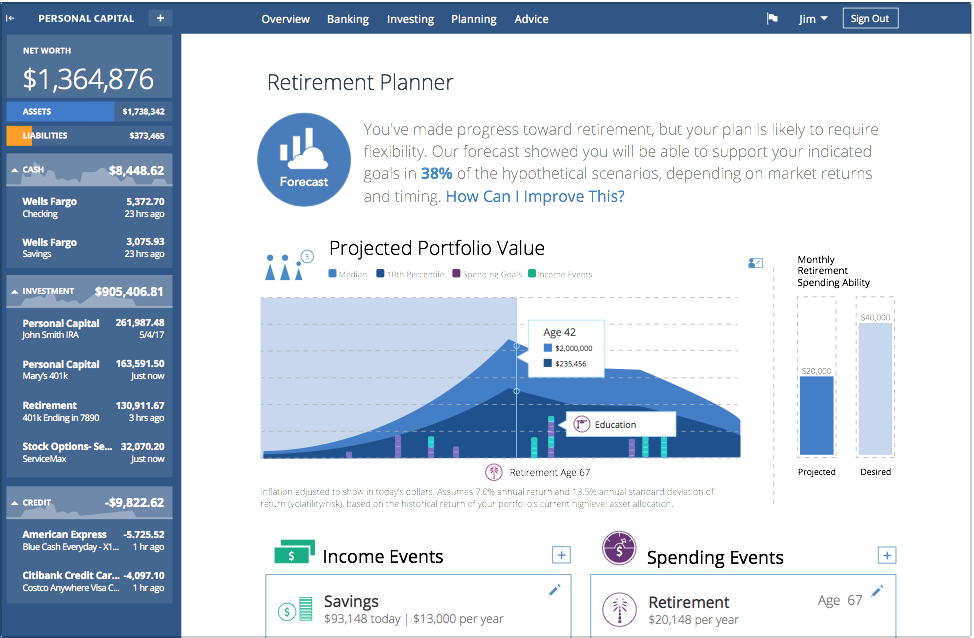

Track Retirement

I'm not a big fan of the retirement calculators out there because sometimes they lull you into a place of comfort. There are so many variables that will go into retirement that it's impossible for one tool to get it right, but I do love Personal Capital's Retirement Tracker because of the holistic view it provides and the ability to add multiple scenarios such as vacation planning, part-time work income or adding new spending goals. The simulation possibilities are endless which make it a nice tool to play around with. For someone looking to retire early and not at the conventional age of 65, I like that their tool is able to give me a forecast of success. Of course, things change all of the time, but it's good to know what the options are.

(P.S. This is not my allocation. Just a stock screenshot.)

How Is This Better Than Mint?

I used Mint for 5 years and I loved it for what it was, which was an expense tracking system. Not sure if it has changed since then, but a few years into using, I got turned off by the lack of updates they had. As a former product manager in adtech, it frustrated me to use such a clunky tool. Their mobile app was great and I would update categories while sitting on the commute to work. They had a lot of good features so I was disappointed when I finally went to do a mass update on my spending categories using their web application and it was awful. I know some people still use both, but I personally deleted my Mint account a year ago. I kept both Mint and Personal Capital for a while, but just couldn't justify maintaining Mint anymore.

So yes, I would highly recommend using Personal Capital to track your personal finances. It has a lot of great features. For all of the things it does, it has pretty responsive user interface. It links to a lot of financial institutions and I haven't had any trouble linking my accounts. The app updates pretty quickly. I'm using IOS and love that I can easily swipe to get high level overviews. So, again it's FREE but they do offer wealth management services for a fee if that's a route you want to go to. It's easy to setup. Perhaps, a few hours out of a weekday and you are pretty much set. With that, there's no excuse not knowing what's happening with your money because it's literally at your fingertips.