“Debt is like any other trap, easy enough to get into, but hard enough to get out of.”

Got debt?

If you are like many Americans, debt is a fact of life.

But we are here to tell you that it doesn’t have to be.

A debt-free life is possible.

Let’s normalize debt-free living.

Know How Much Debt You Have

The first exercise you’ll have to work through is to understand how much debt you have.

This can be as simple as grabbing a piece of paper and writing down who you owe money to.

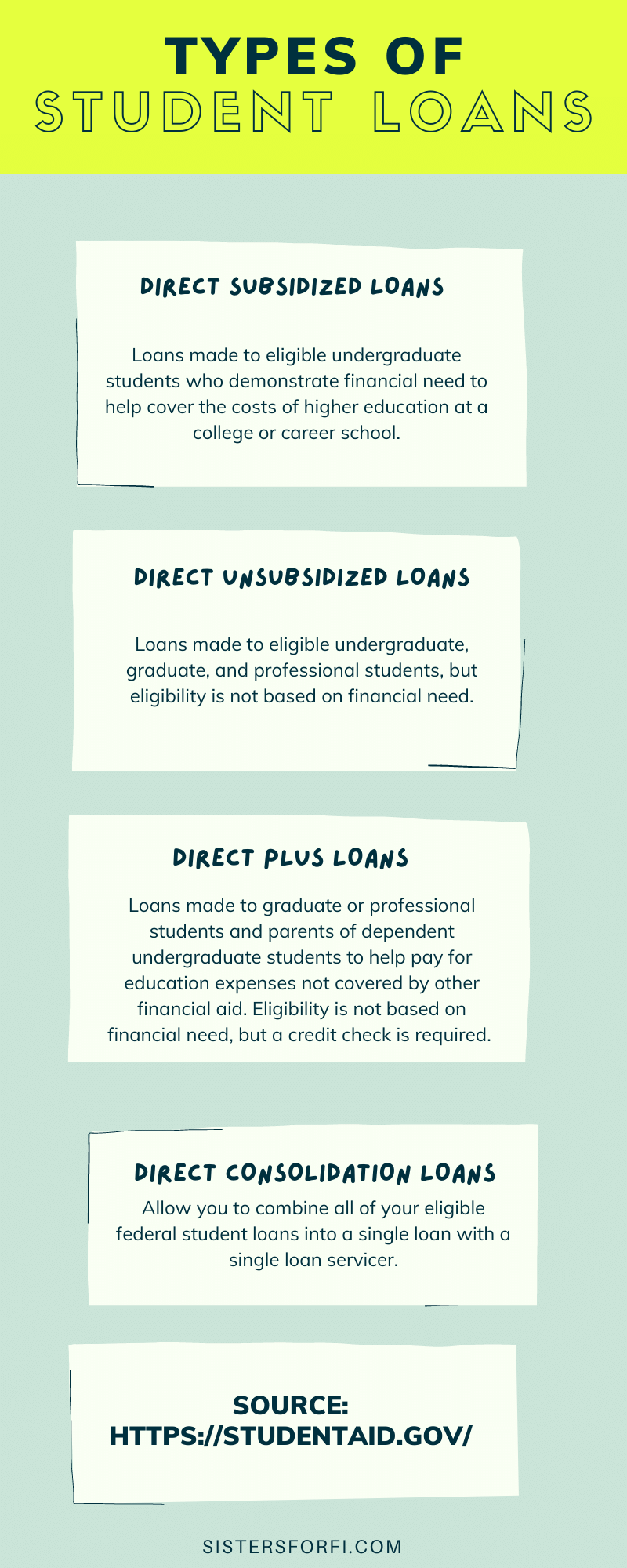

List student loans, car loans, credit cards, mortgage, private loans (anything owed to parents or family members), etc. along with their interest rates, minimum payments and repayment windows.

Articles to read on debt:

How $20 Can Save Thousands Towards Your Debt

Prioritize Which Debt to Pay First

Once you have a list of your debts, select a method to pay it off. The method that works will depend on your accountability needs and your money goals. You can also do a hybrid or change up the method you use. The key is to make progress no matter what.

Pick a Method:

Debt snowball: Method to pay off your smallest debt first (while paying the minimums on the others). This leads to small and quick wins which can be very motivating. After you pay off the smallest loan, you roll the amount you had been paying on that loan into payments on the next largest.

Debt avalanche: Method to pay off your debt with the highest interest rate first (while paying the minimums on the others). This saves more money over the long haul, but can take some time especially if the highest interest debt also has the highest balance.

Debt consolidation: Method to combine multiple old debts into a single new one, ideally at a lower interest rate. This can make payments more manageable since it’s only one payment. Debt consolidation can be done through balance transfers and and personal loans.

How to Stop Adding Expenses to Your Credit Card

An important action to take as you payoff debt is to not add any more. This may mean being ruthless with what you spend your money on…temporarily.

Challenge yourself to go “Cash Only”.

Cut up or freeze your credit cards.

Let family and friends know about your money goals so that they can support you.

Unsubscribe and Unfollow brands and influencers who’ve led you to buy something.

Sell items you don’t use and use the proceeds towards debt payoff or as your cash cushion.