Book Summary: The Little Book of Common Sense Investing

“The two greatest enemies of the equity fund investor are expenses and emotions.”

In honor of the passing of John C. Bogle, found of Vanguard and father of index funds, I picked up the updated edition of his book “The Little Book of Common Sense Investing.” I’ve heard of this book before, but never got around to picking it up. It’s a worthwhile book to read especially for those new to investing or those that need a refresher on the value of investing.

In this post, I am going to summarize many of the strong points Bogle brings up. I highly recommend picking up the book. It’s easy to read, pack full of insights and summaries and well explained graphs. If you are a new investor, I also recommend reading our post “Investing 101 for Women: Resources for the Beginner Investor.”

Choose the Simplest Solution

Bogle is all about simplicity. Why complicate investing when it’s actually very simple. His simple advice: Buy a portfolio that owns shares of every business in the United States and holding it forever. What this essentially means is investing in the Total Stock Market. This means having a piece of every share of American business. It’s so easy for us to think that the U.S. stock market and the U.S. economy is made up of only the large companies like Apple, Google, Facebook, and Amazon, but the market is much larger than that and by owning small and big business, you can capitalize on the growth of one of the strongest economies in the world: the U.S. economy.

The Math Does Not Lie

Bogle explains that when it comes to investing, we always have to turn to the math to see if it makes sense. One of the downsides and reality of investing is the costs of financial intermediation: management fees, portfolio turnover, brokerage commissions, sales loads, advertising and marketing, operating costs, legal fees — all of these costs add up and eat at the returns of investors.

“Before costs, beating the market is a zero-sum game. After costs, it’s a loser’s game. ”

“Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy.”

Bogle points out quite clearly and honestly that the interest of financial institutions and intermediaries is to encourage that the investor or client ignore simple rules of math. “Our system of financial intermediation has created enormous fortunes for those who manage other people’s money. Their self-interest will not soon change. But as an investor, you must look after YOUR self-interest.” How much do expenses hurt your bottom line? A lot. Costs also compound over time. Here’s a graph of what compounding costs can do to your money. The more investment banks take, the less there will be for you, the investor.

The Magic of Compounding, The Tyranny of Compounding Costs. Note the difference in returns before and after costs. It’s in the hundreds of thousands.

Five Options for Improving Your Investment Returns (Only 2 Work)

Select a very low-cost index fund that simply holds the stock market portfolio.

Select funds with rock-bottom costs, minimal portfolio turnover, and no sales loads.

Select winning funds on the basis of their long-term records.

Select winning funds on the basis of their recent short-term performance.

Get some professional advice in selecting funds that are likely to outpace the market.

Bogle has a very popular quote “Don’t look for the needle, buy the haystack” in reference to Option 1. There is never any guarantee of picking a winning fund (Option 3, 4 and 5) so the best bet is to buy the whole thing and let diversification do it’s thing. This is why you’ll always see the disclaimer “Past performance does not guarantee future results.” Why? Well, because the market changes, technology changes. What was once a very popular company or product can be quickly replaced by a newcomer to the industry. Think of all of the companies that have shuttered down: Blockbuster, Toys R Us, Polaroid, Kodak, etc.

Four Decisions on Asset Allocation

Make a strategic choice in allocating your assets between stocks and bonds. Differently situation investors with unique needs and circumstances will make different decisions.

Decide to maintain either a fixed ratio or a ratio that varies with market returns cannot be sidestepped. Periodically rebalancing your portfolio is a prudent choice that limits risk and may well be the better choice for most investors. The portfolio that is never rebalanced, however, is likely to provide higher long-term returns.

Decide to introduce tactical allocation, varying the stock/bond ratio as market conditions change. This carries it’s own risk.

Decide to focus on actively managed mutual funds or traditional index funds. Clear and convincing evidence points to the index fund strategy.

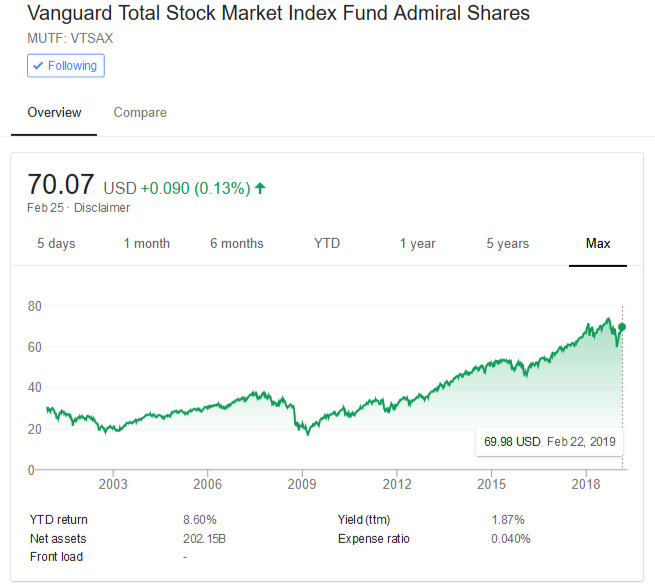

The Vanguard Darling

Bogle’s company, Vanguard, offers one of the most popular Total Stock Market Index Fund, called VTSAX. It is a mutual fund that is bench marked against the Total Stock Market Index. Here is a snapshot of it’s growth since inception. VTSAX has one of the lowest expense ratios at 0.040% .

VTSAX is a darling in the Financial Independence/Retire Early movement because of all of these reasons. Given an early investment in this fund can provide great results. I, personally invest in a similar fund like this and we also started my younger sister (college aged) to invest her first internship paycheck in this fund. See our strategy for that here.

Stock quote of Vanguard Total Stock Market Mutual Fund (VTSAX). One of the most popular, low expense funds that is bench marked against the total stock market.

Hypothetical growth of $10,000 if as of 01/31/2019.

The Double Whammy of Emotions and Expenses

The two biggest enemies of any investor is emotion and expenses. By removing both from the equation of investing, the investor will be better of. Investors, you and me fear when the market goes down and that fear leads us to pull money out when in fact, this is the time to buy. Think of it as the market being on sale. On the other hand is the idea of expenses or costs that we covered above. When we don’t actively review expenses of our investments, we lose out on hundreds of dollars. It’s important to look out for these two when we invest and this is where index fund investing can provide the security and peace of mind that many of investors need and want.

Don’t regret not investing sooner because you feared it.

Sign-up for this FREE email series on Investing 101.

Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy. - John C. Bogle

The two greatest enemies of the equity fund investor are expenses and emotions. - John C. Bogle

Book Summary: The Little Book of Common Sense Investing