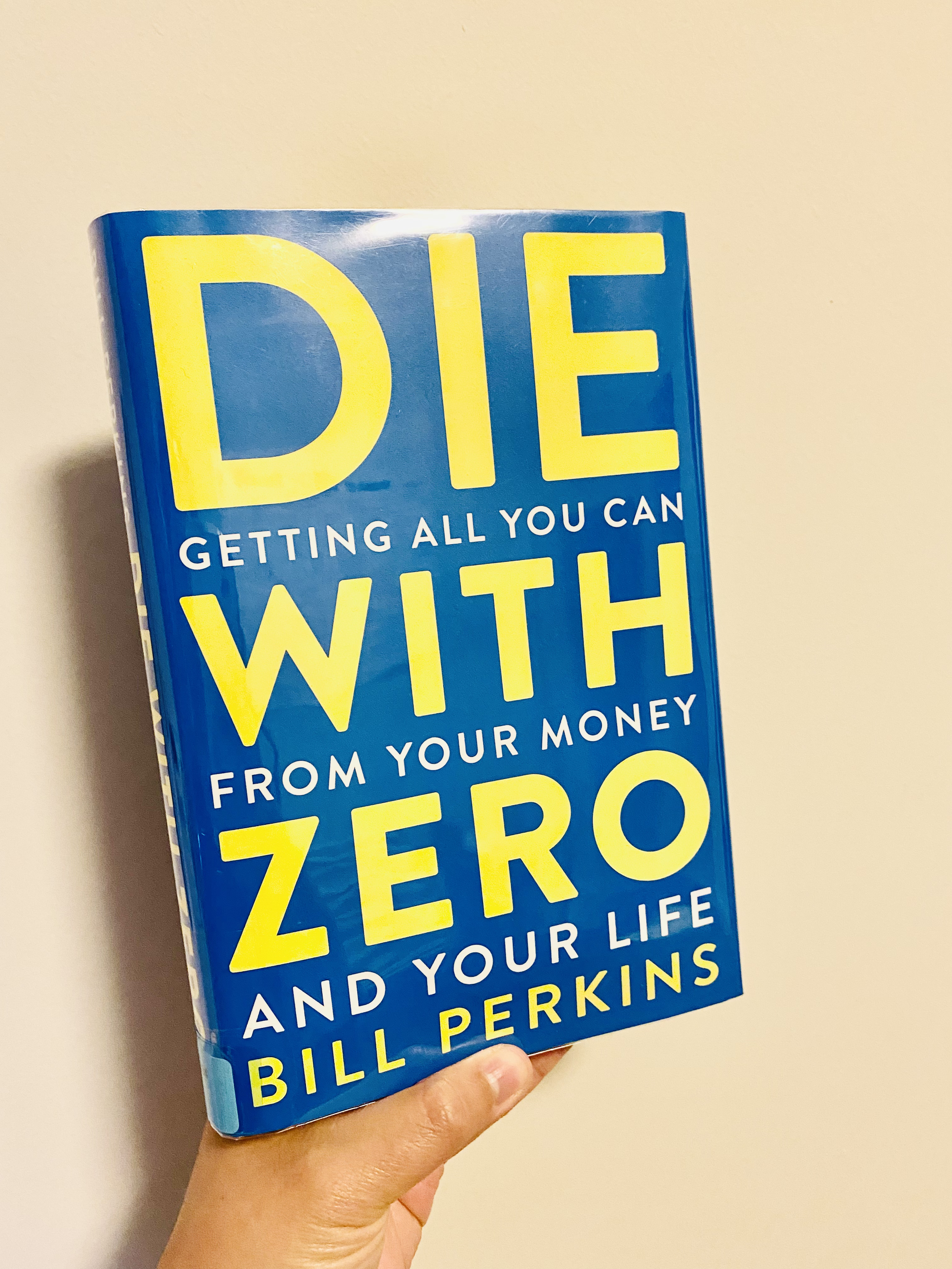

This month’s book is called Die With Zero: Getting All You Can From Your Money and Your Life by Bill Perkins. In short, the book is a personal finance book, but it doesn’t talk about saving, budgeting or investing like the majority of personal finance books though. This book instead talks about using your money intentionally to fund and find fulfillment.

All tagged financial books

Book Review and Summary: The Debt Trap by Josh Mitchell

This month’s book is The Debt Trap: How Student Loans Became a National Catastrophe by Josh Mitchell. It was written by a reporter from the Wall Street Journal who has years of experience writing about the economy and higher education.

The book covers the history of student loans and the creation of the college industrial complex. I didn’t know much about how the idea of student loans came about so the book was an insightful look at the players that eventually created a big business that impacted most of our lives.

Book Summary: The Color of Money - Black Banks and the Racial Wealth Gap by Mehrsa Baradaran

“...the currency of the South was the slave”

This month’s book is “The Color of Money - Black Banks and the Racial Wealth Gap” by Mehrsa Baradaran. It covers the history of Black banking and the role of racism in the economic independence of the Black community.

Today, on every socioeconomic level, Blacks have significantly less wealth than whites. The book explains how the racial wealth gap was created that continues to affect millions of families in the United States. There were also many laws and policies like the GI Bill, the Homestead Act and the FHA that denied the Black community the opportunity to advance and economically prosper.

Book Review and Summary: Tales of Horror and Happiness in Hospitality

HOSPITALITY, n. The virtue which induces us to feed and lodge certain persons who are not in need of food and lodging.

This month’s financial book is a bit different than past books. The book is titled: Tales of Horror and Happiness in Hospitality by Dr. Kiona and Maria Gangat. You can find it on Amazon (linked) or check out her Instagram story highlights for more info.

This book covers two prevailing concepts that’s heavily discussed in the financial independence, retire early (FI/RE) community: house hacking and geoarbitrage so it fits in nicely here.

Book Review and Summary: The Do Gooder's Guide to Investing by Adrian Reif

“It turns out you can give your money to a project positively impacting the world with the goal of earning a financial return.

Can you grow your money while investing in positive change for people and the planet? I believe that we can and this book The Do Gooder’s Guide to Investing by Adrian Reif provides a roadmap on how we can do all that.

The word “investing” can sometimes get a bad rap because it’s associated with Wall Street, but it’s absolutely possible to invest in affordable housing, renewable energy and local communities and still grow your money. The Do-Gooder’s Guide to Investing provides a comprehensive list of these investing options. Even if you are not ready to invest yet in these organizations, I highly recommend reviewing and learning more about the organizations that Adrian lists as it will give you some hope about the future.

Book Review and Summary: Women & Money by Suze Orman

Put a value on what you do and do not let anyone to undervalue you."

The last book of the year in the Book of the Month Series is Suze Orman’s Women and Money: Be Strong, Be Smart, Be Secure. I’m a fan of Suze Orman. It was her book Young, Fabulous and Broke that actually started my FI journey many years before FI was even a term for the mainstream.

The first version of this book was published back in 2007. I remember reading it, but at that point in time, I was in a completely different mindset and I glossed over most of the topics. Fast forward to 2019 and I now see many of the topics having some relevance in my life.

Book Review and Summary: The Dumb Things Smart People Do With Their Money

This month’s book is The Dumb Things Smart People Do With Their Money by Jill Schlesinger. Each chapter of the book is a topic on the dumb things smart people do with their topic. I appreciate the book for the straightforward way the author described the Dumb Things. The topics are all worth reviewing and revisiting. It’s especially important if you are busy building wealth or hitting that FI number that there’s other things we all need to look at to protect our wealth and the security of our loved ones.

Book Review & Notes: Women With Money by Jean Chatzky

Women are very clear about what we want from our money. We want to satisfy our needs for safety and security.

This month’s book is Women with Money: The Judgement Free Guide to Creating the Joyful, Less Stressed, Purposeful (and Yes, Rich) Life You Deserve by Jean Chatzky.

Book Review & Notes: Broke Millennial - Get Your Financial Life Together

You, right now, have a choice: you can let money control and define your life or you can control it. - Erin Lowry, Broke Millennial

This month’s book is Broke Millennial by Erin Lowry. You can read more about Erin on her blog, brokemillenial.com.

The title of the book can peg it as a book specifically for Millennials, but I disagree and encourage you to pick it up if you are looking to up your financial knowledge no matter what age you are. It’s not a book on investing or retirement, which I think makes it better. It’s a comprehensive on the basics of money mindset, credit, student loans and debt. The content in this book provides a good foundation for better money management and eventual wealth creation.

Book Review & Notes: The Power of Zero - How to Get To the 0% Tax Bracket

Social Security was never intended to be a retirement program. It was merely insurance against living too long.

This month’s book review and notes are from The Power of Zero - How to Get To the 0% Tax Bracket and Transform Your Retirement. Learn more about David McKnight over davidmcknight.com and listen to his podcast via YouTube. Fitting since we are just about to close out tax season. Perhaps, the lessons in this book will change the way you manage your money to be more tax efficient now and always.

Book Summary: The Little Book of Common Sense Investing

“The two greatest enemies of the equity fund investor are expenses and emotions.”

In honor of the passing of John C. Bogle, found of Vanguard and father of index funds, I picked up the updated edition of his book “The Little Book of Common Sense Investing.” I’ve heard of this book before, but never got around to picking it up. It’s a worthwhile book to read especially for those new to investing or those that need a refresher on the value of investing.

Book Review & Notes: Financial Freedom by Grant Sabatier of Millennial Money

When the opportunity to sign-up to preview Grant Sabatier’s new book Financial Freedom: A Proven Path to All the Money You Will Ever Need came up, I jumped at the chance and am so glad I did. It is jam packed with actionable insights. More importantly, it gives you a blueprint of how to achieve Financial Independence early on. There’s also an important question that Grant addresses “Why do you want to retire early?” Retirement while your fully financial independent is all about options and its all about choices.

19 Financial Moves for 2019

The best time to plant a tree was 20 years ago. The second best time is now.

Happy New Year! Another year, another 365 days of well-meaning resolutions. To help you achieve your financial goals, we’ve come up with 19 actions items to take into the New Year. Yes 19! Pick one or two to focus on the first quarter, then another two for the next quarter. Do not overwhelm yourself by doing too much.

Book Notes: Financially Stupid People Are Everywhere (4 Rules to Follow to Be Financially Smart)

“They sit mesmerized before advertising campaigns telling them to buy trifles they don’t need using debt they can’t repay.”

In “Financially Stupid People are Everywhere: Don’t Be One of Them,” Jason Kelly opens your eyes to the debt driven world we live in and what you’re up against in society. He posits the only way to truly safeguard your own well being is to look after yourself. Provide security and ensure your freedom by following the 4 financial rules that will keep you from being financially stupid.

The Four Tendencies and Personal Finance: How to Motivate Yourself to Take Action Towards Financial Independence

“It’s been freeing to focus on what works for me rather than what’s wrong with me.”

I just recently finished reading Gretchen Rubin’s The Four Tendencies. In the Four Tendencies, Gretchen Rubin, outlines four different personality types based on how each one deals with inner and outer expectations: Upholder, Obliger, Questioner and Rebel. By understanding our Tendency, we can harness that to find our own internal and external motivations.

Book Notes: The Energy of Money

Life is hard when you don’t do what you truly value because you are putting all your energy into trying to get rid of your fears rather than into materializing your dreams.

You can dream about money, you can tell the universe you want money, but if you don't take any action towards it, it will never materialize. All of the people in our lives have instilled upon us THEIR beliefs about money. Our past circumstances may have dictated where we are now in life, but at this moment in time, we have the power to change that. All it takes is purposeful action.

We will look at what times in the context of The Energy of Money by Dr. Nemeth.

Book Summary: Your Money Or Your Life

"Waste lies in not in the number of possessions, but in the failure to enjoy them."

I had the chance to pick up Your Money or Your Life by Vicki Robin and Joe Dominguez. They are thought to be the ones that coined the term "FIRE" A writer from a FI group in NYC brought the book and passed it around. It didn't click to me that this was the book. I had it on my reading list and bumped it up so that I could review it earlier. I'm so surprised I hadn't come across it earlier in all of my reading, but here we are and it seems like everything about the FI concept is falling into place for me.