Book Summary: Your Money Or Your Life

"Waste lies in not in the number of possessions, but in the failure to enjoy them."

I had the chance to pick up Your Money or Your Life by Vicki Robin and Joe Dominguez. They are thought to be the ones that coined the term "FIer". A writer from a FI group in NYC brought the book and passed it around. It didn't click to me that this was the book. I had it on my reading list and bumped it up so that I could review it earlier. I'm so surprised I hadn't come across it earlier in all of my reading, but here we are and it seems like everything about the FI concept is falling into place for me.

This post contains affiliate links. See Disclosures for details.

“Financial independence is the natural and inescapable by-product of life. After a certain point, you will no longer earn a living. The only choice in the matter is when and how the point is reached.”

I love this book because it is one of the few books that relate our consumption with the wallet and the planet. It also talks about the concept of the Fulfillment Curve. It is a concept that explains that for many of us, we already have everything we need. This is our Enough point. The graph below explains it best. Enough is plenty.

Your Money or Your Life goes through 9 Steps to transform your relationship with money and achieving financial independence. I have listed them below as well as my commentary on the step. I do highly encourage you pick up the book (from your library) as there are many concepts in there that might strike an idea today or tomorrow. It's a long book like most personal finance books. The book covers a lot of exercises. Sometimes, it goes into it a little too much, but for those starting out, I would highly recommend going through the exercises carefully and diligently.

1. Make Peace with the Past

“What do you have to show for the money you’ve earned?”

This is an important start and I'm glad the book tackles this first. The important thing with any journey is to acknowledge the past, learn from it and move on. Specifically in the personal finance world, many of us dwell too often on the mistakes of the past or past conditioning to move from our current state. We are influenced by many things even before we truly understand what money is so it's time that we make peace with the past.

The action item in this step asks you to add up your lifetime income, your net worth, your lifetime wealth ratio, your assets, and your liabilities. It's an eye-opening look at where our money has gone all of these years. We will also get a chance to look at our worth. Have we been valuing ourselves and earning the income that we deserve?

The numbers may shock you, but it’s important that at this step, we commit to a "no shame, no blame" approach. Personal finance is different for all of us. That's why it's call "personal" finance. We need to start moving away from the shame of our mistakes and stop blaming others for mistakes as well. This really goes into the concept of the money mindset. It's important to shift the way we all think about money in order to get the life that we want.

Check out this video of Ramit Sethi of iwillteachyoutoberich.com go through the Psychology of Money. Where you do find yourself? Who influenced your money habits? How can you accept, move on or carry those influences? How can you use what you've learned about your money to move forward?

2. Being in the Present - Tracking Your Life Energy

“How much money are you making for the amount of time you work?”

This step is an eye opening look at how we exchange our time for money. When we normally calculate our hourly wage, we automatically just divide our salary by the number of hours at work, but it's actually more complicated than that. Depending on the job that we have, we spend money, time and mental energy to commute, to dress for work, to plan, to prepare. This all takes time, but we don't include this in the calculation. This is important to do because this is the overall exchange of our time for money.

When you get down to the details, 40 hours at work + 10 hours of commute time, + 2 hours checking email after work + 2 hours shopping and figuring out what to wear means already 56 hours focused on work which if we divide using our salary, our hourly wage has already declined. This adds up, but this isn't even the end. When we think about tracking the life energy, we also need to track every cent of where our money is going. We exchange our time for money. We buy things and services with money so where is our time going? The action item in this step is to track where every penny is spent in the month so you get a sense of where money is going and where your life energy is going.

3. Monthly Tabulation

“Just say yes to being conscious. ”

This is a great exercise to really see how much you spend. Sometimes this number gets nebulous and sometimes we just don't want to face it, but we do need to sit down and map out where our money is going. It's easy to say money goes to food or to transportation, but what's the breakdown. Why are these numbers so high or so low? What can be done to curb spending on specific categories?

It's also important to understand how much it really takes to keep you basic needs met. Is it as much as you think? How much of the spending are unconscious and wants instead of true needs? The numbers don't lie either. It's objective in what it tells you. When you know these numbers, convert it back to your hourly wage, how much of your time was spent to buy it?

The action item in this step is to create income and expense categories that is unique to your own life.

4. Three Questions to Transform Your Life

“You can never have enough if you are measuring by what others have or think.”

The three question below are used to rate your spending. It's what the book calls the "internal yardstick for fulfillment." It basically questions each line of your monthly tabulation to see if it was truly worth the price and expense. Note that now we aren't just looking at cost of things, but also time and mental energy costs.

Did I receive fulfillment, satisfaction and value in proportion to life energy spent?

Is this expenditure of life energy in alignment with my values and purpose?

How might this expenditure change if I didn't have to work for a living?

5. Making Life Energy Visible

“Transforming our relationship with money takes time and patience.”

This step is akin to a vision board. Seeing reminders of where you want to focus your money and your energy to is a big signal to yourself and to the universe about what's important to you. Each reminder also signals and makes you question how you live and optimize each day. Is it towards your goals?

This step is basically look at a chart of your expenses over time. Are there dips and spikes? The goal is to keep your expense trend line flat or declining as you get better about spending, reducing debt and improving savings. The goal is to make this chart visible so that you see it everyday. It can be printed, but since it's 2018, my fave way to do this is to use Personal Capital to see my net worth, expenses and income. It's accessible on my phone so easy for me to get to anytime of day.

6. Valuing Your Life Energy - Minimizing Spending

“Save money, save the planet. Money is a lien on the life energy of the planet.”

This step is about the consciously lowering and eliminating of expenses. We live in a world of over abundance. We continuously buy, upgrade, and get the latest and greatest when we don't need it. This results in a skinny wallet and a planet bulging with waste.

Here are 10 Ways to Save Money:

Don't go shopping. Don't make shopping a past time. Avoid advertisements and marketing.

Live within your means. Be careful with credit.

Take care of what you have. Pay attention and practice small steps to extend the life of objects and yourself.

Wear it out. Trends come and go. Use things wisely and gain maximum value out of them.

Do it yourself. Learn a few basic skills like cooking, sewing and plumbing so that you don't have to pay someone to do it.

Anticipate your needs. Think ahead about your true needs so that you can plan ahead.

Research value, quality, durability, multiple use and price. Buy quality and know where it came from.

Buy it for less. Research, negotiate or buy used to get an item for less.

Meet your needs differently. Figure out alternative solutions to your needs.

7. Valuing Your Life Energy - Maximizing Income

“You want more money as an expression of your self-esteem, of valuing your life energy.”

This last step is about valuing your life energy and increasing income. It's knowing the difference between your life's work and paid employment. It's understanding that your time is valuable. It's finding your purpose and putting in the intention and willingness to achieve that purpose.

Don't be passive about the size of your earnings. Cultivate positive attitudes, take pride in what you are doing and ask to be paid for your value and results. They key is to change why you want to spend more hours at work. Not for money or greed, but so that you can reclaim your life energy, so that you can get out of debt faster, so that you can save more and create security for yourself.

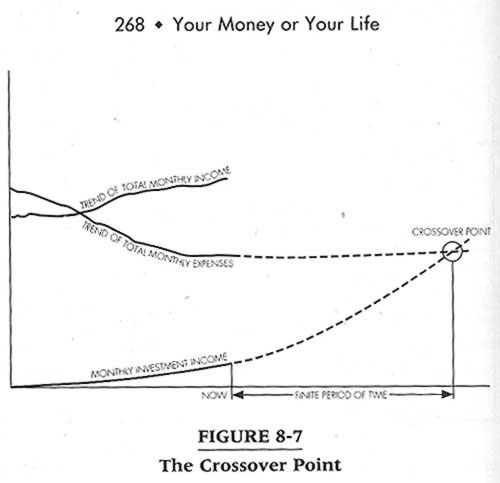

8. Capital and the Crossover Point

“The Crossover Point provides us with our final definition of financial independence. At the Crossover Point, where monthly investment income crosses above monthly expenses, you will be financially independence in the traditional sense of that term. You will have a safe, steady income from a source other than a job.”

The holy grail of Financial Independence is the Crossover Point. It's when your savings and investment income generate enough to meet your expenses. This is the baseline Financial Independence. This is where we all strive for. The question is whether this happens at 65 (hopefully) or sooner. At this time point, you can stop working for money, but if you like what you do, you can absolutely continue what you are doing as long as you continue to exchange your life energy in a way that serves your purpose. If you follow the steps above, you should see a growing difference between income and expenses. The difference should be in savings/investment.

Your Money or Your Life: The Crossover Point

And if you are a data visualization or numbers nerd, this tracker may be the one for you. It’s available from @mywealthdiary over on Etsy and allows you to figure out your Crossover Point using a sleek graph and Google Sheets input. You’re Welcome! ;)

9. Managing Your Finances

“Empower yourself to make financial choices about long-term income-producing investments.”

Don't leave it to the "experts." Now that you've faced your finances head on, understand where your money is going, know the value of true work and understand how much of your life energy you want to expend, educate yourself on how to make your money work for you. The experts don't know everything and sometimes don't have your best interest at heart. Get informed and empower yourself to ask the right questions. There are no quick wins in FI so be weary of those offering such solutions.

The recommendation in the original book was to put the money saved from following the steps above and invest it in Treasury Bonds, however, the returns on certain bonds isn’t what it used to be. In the latest update, there is now a section on investing in low-cost index funds that cover the total stock market with references to The Simple Path to Wealth and the Bogleheads strategy, as well as real-estate. Of course, by the time you read this, there may be other investment options that can yield similar risk and reward. With this last step, it's important to realize that now your money works for you.

Final Thoughts

I highly recommend this book and recommend re-reading it every year to let the ideas sink and shift as you and your goals change. It's a whole new way to look at how we work, how we spend, and what we value. The by-product of all of these steps is Financial Independence. In the end, all of steps will lead to you to optimize your spending, increase income, and increase savings and investment in such a way that investment income will crossover to your expenses and true Financial Independence will be achieved.

Have you read Your Money or Your Life? What are your thoughts? What Step stood out to you the most?

Here are other articles on this book and the author:

A Growing Cult of Millennials Is Obsessed With Early Retirement. This 72-Year-Old Is Their Unlikely Inspiration (Money Magazine, latest)

Ten Books That Changed My Life #10: Your Money or Your Life (The Simple Dollar, oldie but a goodie)

Actual Book Summary from the Your Money or Your Life site

We also created The Money Journal to help you with your money. It’s part finance book, part workbook, part journal to help you understand your money mindset and get a plan of action to reduce debt and save more. Check it out The Money Journal!

“Financial integrity is achieved by learning the true impact of our earning and spending, bot on your immediate family and the planet.”

Book Summary: Your Money Or Your Life