Die with Zero by Bill Perkins: Book Summary and Review

When our library opened up again for in-person visits, I was ecstatic. Browsing the library is the best way for me to find books I want to read. I mostly stick to the new non-fiction section. This month’s book is called Die With Zero: Getting All You Can From Your Money and Your Life by Bill Perkins. The title of the book sounded familiar, but I was not familiar with the author or the concept.

In short, the book is a personal finance book, but it doesn’t talk about saving, budgeting or investing like the majority of personal finance books though. This book instead talks about using your money intentionally to fund and find fulfillment.

The book resonated with me for a few reasons:

Ever since I started earning my own money, I often had conflicts with my mother about the way I spent my money. My thought process then was that I won't be able to take this money to the grave, might as well live it up. The #YOLO concept. In reflection, I think we both were right about finding that balance between spending money intentionally and saving and investing for the long-term.

As I was reading the book, our grandfather died. He was 100 years old! He lived a century! We last saw him in 2017 when our entire family went to the Philippines. While my sisters and I didn't get to spend a lot of time with our grandparents because we lived in the States, the thing I remember most about my grandfather was that he always listening to the radio. As he got older, his body was failing him more than anything, but his brain was still on fire.

I wonder what kind of memories he was reliving throughout all of these years? Did he think he was going to live until 100? If he did, how would he have changed how he spent this money early on?

The Die with Zero Chapters

Optimize Your Life (Maximize your positive life experiences)

Invest in Experiences (Start investing in experiences early)

Why Die with Zero (Aim to die with zero)

How to Spend Your Money (Use all available tools to help you die with zero)

What About the Kids (Give money to your children or to charity when it has the most impact)

Balance Your Life (Don’t live your life on autopilot)

Start to Time-Bucket Your Life (Think of your life as distinct seasons)

Know Your Peak (Know when to stop growing your wealth)

Be Bold - Not Foolish (Take your biggest risks when you have little to lose)

Optimize Your Life and Invest in Experiences

The big premise of the book is to understand that time is finite so it’s necessary for all of us to stop running on auto-pilot and be more intentional with how we spend our time and money. Life is all about an exchange of energy. Many of us exchange our time for money in order to be able to afford the basics, but there may come a time when we have enough and it’s necessary to pause and figure out if the life energy exchange for more money is worth it.

This energy concept has also been covered by Your Money or Your Life, a very popular book in the FIRE Community and one I would recommend reading that as well.

The author encourages all of us to start investing in memories and experiences early on. Sure, some experiences will cost money, but with a little legwork, it may be possible to find experiences at reasonable costs.

So the idea then is to get a bit smarter about how you spend your money and contrary to mainstream advice, it may be beneficial to actually sacrifice saving early on and instead spend that money on experiences. A big reason to do this is because as the years progress, the balance of health, money, and free time will start to shift. So depending on where you are in life, it's important to invest in the experiences that provide the right fulfillment for you. If you aren't sure what will provide you fulfillment, there’s a time bucket exercise that the author shares and that I have outlined below.

A big factor for all of this is health and no matter how you look at it, a 25-year-old will almost always be healthier than an 80-year-old so it’s time to think about how to improve your health as you age AND spend money in a way that allows you to take full advantage of good health early on.

Health and Wealth have different curve lines with health declining over time and wealth rising over time so at some point you’ll need to find the optimal age to do what you want given your money, time, and health.

Another thing too as you think about investing in experiences early on is that there’s a lot more you can handle at full health. If you don’t have enough money, there’s ways to put up with a little bit of inconvenience to save money. As you get older or if/when you have kids in tow, sometimes it won’t be possible to take the cheaper flight with the layovers or the stay in the hostel or get a last minute ticket for a once in a lifetime activity.

Die with Zero

The Concept of the Memory Dividend

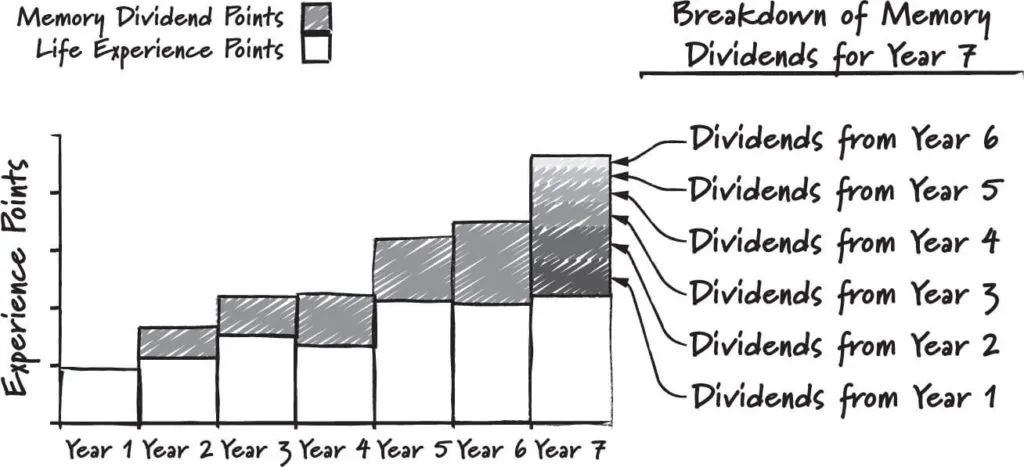

The book introduces the concept of the memory dividend. This is very similar to the dividend concept in investing. In this case, the more experiences and memories you have, the more likely you can reap the rewards/dividends of these experiences. Recollecting these experiences can bring about joy, it can reconnect with you people, and these pockets of happiness can add up. It’s a powerful way to continuously reap the benefits of an experience that has long passed.

Die with Zero: Memory Dividends and Life Experience

Memory Dividend from Die with Zero

Memory dividends are very powerful tools that even tech giants like Facebook, Google, and Apple use to bring you back on their platforms. If you’ve ever viewed or shared Memories through Facebook or downloaded photos from a reminder of On This Day, these speak to the power of memories.

Memories also happen on multiple streams: your memory with that person and that person's memory of you. So when you invest in an experience, you are investing in multiple streams of dividends. If you are a parent, thinking about memories in this way may encourage you to create more memories with your kids should the unthinkable happen to you. How would you want your kids to remember you given the money and time you have today?

Kids and Charity

The author includes a chapter on kids and charity. When many people learn of the concept to “die with zero”, they retort back “what about the kids?” The author answers back that the goal “to die with zero” is not about being careless with your money, but about being intentional with the way you spend money including giving money today instead of tomorrow. His answer is that you should give at the time when it can bring optimal usefulness or enjoyment (peak utility of money.) It’s also worth giving when you are alive so that you can see the impact of your monetary gift. He cites U.S. inheritance data that majority of family members get inheritances later in life which is suboptimal.

By the time inheritances are doled out:

the people in your life may no longer need the money or be around to enjoy it (random people)

the amount you give will mostly be determined by what you have not spent (random amount)

the date will be some random date after your death as dictated by a will or the court system (random time)

When this happens, inheritance becomes just a random thing with no intentionality behind it.

When it comes to charity, there are causes and people now that can use your generosity. Waiting until you die may mean a larger gift to give, but it may be too late for some to benefit from your gift. Think for example about gifting scholarships today instead of tomorrow as that kind of gift could change someone’s future path.

How to Not Die with Zero

Dying with nothing left or having just enough is all about intentional planning. You still need to save and invest for the possibility that you will live a long time. There is a big question though about how much do you really need to ensure you have enough money to live on. I shared earlier in this post that our grandfather lived to be 100 years old. That’s an age I don’t think he ever thought he would reach. but we all need to account for that possibility.

The author does provide a formula called the survival threshold in which to base how much money you’ll need to save at bare minimum to be able to start withdrawing without needing more money until you die. It’s very similar to the FIRE number, but takes into account your likelihood of living past a certain age. For that likelihood, you’ll need to visit your doctor to get a reading on your biological age and maybe look at your family history.

Survival Threshold = 0.7 x (cost to live one year) x (years left to live)

With the exception of health care, almost all expense as you get older will likely decline so it may not be too farfetched to estimate a lower cost of living. For every other expense that may worry you, there’s most likely a combination of insurance, annuities and other investments you can tap into to protect you. Of course, if mind and body are still willing, you can continue to work so you aren’t drawing down on your net worth. And keep in mind that you must be investing in something that returns you interest above inflation.

Once you reach your net worth peak, it’s time to decumulate, which means it’s time to spend your money. Because you know what this number is, you may now be able to attach it to a date at which you can start spending money or giving it away to those who really need it instead of continuing to hoard all the wealth. In this scenario, your net worth should peak earlier (in your 50s-60s), instead of peaking closer to your death which means you are now on track to die with zero.

Die with Zero: Net Worth Peak

Time-Bucket Your Life

By now you’ve probably heard of the Bucket List concept in which you create a list of all of the things you want to do in your life. In the time-bucket exercise, you’ll instead list out all of the key experiences — activities or events — you want to complete in your lifetime agains time periods. It’s a fairly simple exercise, but once you start doing the exercise you may realize that some activities may be better off being completed within the next few years, some can wait, some require planning, and some can be done over a longer period of time.

The book has an accompanying app that you can use to create these time buckets, but a Google Sheet or Excel will probably just do fine. If you have a bucket list already, try to move those into the time periods so that there’s a sense of urgency with them.

I will also encourage you to write down past activities in a separate tracking sheet so that you can build up your memory bank. You may find some activities in the past that you haven’t thought about which creates those memory dividends for you.

Die with Zero: Filling Your Time Buckets

Final Thoughts

This book may be at odds with the mainstream advice to save early and often, but I think it goes inline with the original FIRE principles from Your Money or Your Life where you focus on being intentional with the life energy you trade for the life you want. A big part of the original FIRE principle was to be mindful of where your life energy is going. Are you exchanging your time for stuff you don’t need and in a cycle of consumerism that’s not resulting in quality life experiences and memories?

There’s certainly a privilege to be able to decumulate wealth especially as there’s a percentage of the population that is unable to meet basic needs and retiring in poverty. This book has a very specific audience and perhaps that audience could use a little lesson in enjoying life a bit more and encouragement to not hold so much wealth that you can’t use it.

For me, even though I probably could have invested more in my 20s, the money I spent in my 20s and 30’s have provided me so many great memory dividends. From going on safari at 24 years old to bungee jumping off a bridge to bringing our entire family to Istanbul for a wedding to hiking the Machu Picchu trail with 12 friends, thinking back on those experiences always make me smile. Would I be able to do those now? Maybe, but it will be a completely different experience given we now have a toddler, most of our friends are also "settled", and my parents are now older. And there is still a case to be made too with saving and investing early as those funds have provided me greater financial security and more options.

At the end of the day, we all need to find that balance of living in the present and saving for the future (and in some cases paying for the past). The idea to die with zero is really to not leave life on the table (or in this case the spreadsheet).

Book Summary and Review: Die With Zero by Bill Perkins