7 Ways to Strengthen Your Family Finances While Under Self-Quarantine

"No winter lasts forever; no spring skips its turn."

As the effects of COVID-19 are being felt globally, many leaders have asked citizens to self-monitor themselves for symptoms of the virus. In addition, many towns are also asking citizens to self-isolate and self-quarantine to prevent the spread of the virus even further. Self-quarantine can seem scary as it means being isolated from people and things that we love. Instead, let’s look into self-quarantine as an opportunity to catch-up on the things we’ve not had time to do due to personal, professional and familial obligations.

Of course there are many things you can do at this time like spend time with family, work on a passion project, but since this is a personal finance site, I think the biggest opportunity here is the time you’ll have to review and manage your finances. Now is the time to act. If you have a bit of downtime, instead of fully engaging on Netflix marathons (which is fine in moderation), may I suggest taking a look at this list of items you can do to strengthen your finances for the days ahead. I hope nothing like this ever happens again, but we live in a fast moving, constantly changing world and we can’t predict the future. What we can do now is prepare for the inevitable. Whether you are single, married, don’t have kids, have kids, take care of other family members, etc., taking certain actions today to strengthen your finances can provide much needed relief in the future.

This post contains affiliate links. See Disclosures for details.

Check Your Credit Report

It doesn’t sound sexy, but if you have the time now, sit down and take a look at your credit report. Head to annualcreditreport.com to obtain FREE copies of your credit report. This is a government site authorized by Federal Law which allows you to pull a copy of your credit report once a year. The goal of reviewing your credit report is two folds:

1) Review that all of your credit history and information is accurate as this information is what is used to give you credit and loans. This means if you are looking to get a credit card, a mortgage, a new apartment or a car lease, this is the information that will be reviewed to see if you make a good borrower. If information is incorrect, it is your responsibility to get it corrected.

2) Review that you have not been a victim of identity theft. Identify theft is very common nowadays and it’s important that we review our information to make sure others have not used our personal information for their own gains. It would be ashamed to find that someone else has been living large on our identity.

Checking your credit report can be done all online at annualcreditreport.com. So no up close interaction is needed with others. It will then take a few hours to review so add this item as a to-do on your calendar every year moving forward.

Negotiate Lower APRs on Your Credit Cards

This tip is all about negotiating to get a lower interest rate on your credit card. A few percentage points off your rate can mean hundreds to thousands of dollars in savings. Most people don't know that you can negotiate your credit card interest rate and it's fairly easy to do. This is helpful if you carry a current balance on your card. This is also helpful if you don’t carry a balance because someday you might and having a lower APR means you won’t be paying too much to borrow money.

Here's how to do it.

Note your credit card APR (interest rate), balance and how long you've been a customer. Check your statement for this information.

Call the number on the back of the card and ask to speak with a representative.

Ask the rep to confirm what your current APR is and ask them what they can do to lower it.

If the rep is not able to lower the APR, ask what they can do for a long-time card member. Let them know that you've been a customer for X years and would like to stay a card member.

If the rep is able to lower the APR, ask to see if they can lower it another 2%. It never hurts to ask .

Once they provide the new APR, have them confirm it and ask when it will go into effect.

If you’ve take the Find Free Money Challenge, you’ll remember this action item. It’s good to do this once a year and get your APR as low as possible.

Review, Discard, Shred Old Paperwork

Now that we are spending more time at home, let’s get started with some early spring cleaning. A good place to start is to review old paperwork you may have stuffed in your desks and shelves. You know what I’m talking about because I, too am guilty of letting paperwork pile up. I’ve learned that sometimes paper clutter can really wreak havoc on our mindset and sometimes on our financials. A forgotten bill, a missed check, you never know what you may find in that mess so take the time to sort through it all. This may also be the time to start signing up for electronic delivery of bills and notices and opt-out of advertising and marketing. You can head out to Opt Out Pre-Screen to get yourself removed from mailing lists that you no longer want or need.

Here’s a list of paperwork to review and how long to keep them for. If you are still unsure of keeping some of these items, invest in an easy to use scanner so that you still have electronic copies of them. The best thing about getting organized is that it will be easy to find documents later on when you need them which saves time and money in the long run.

Review Your Investment Fees

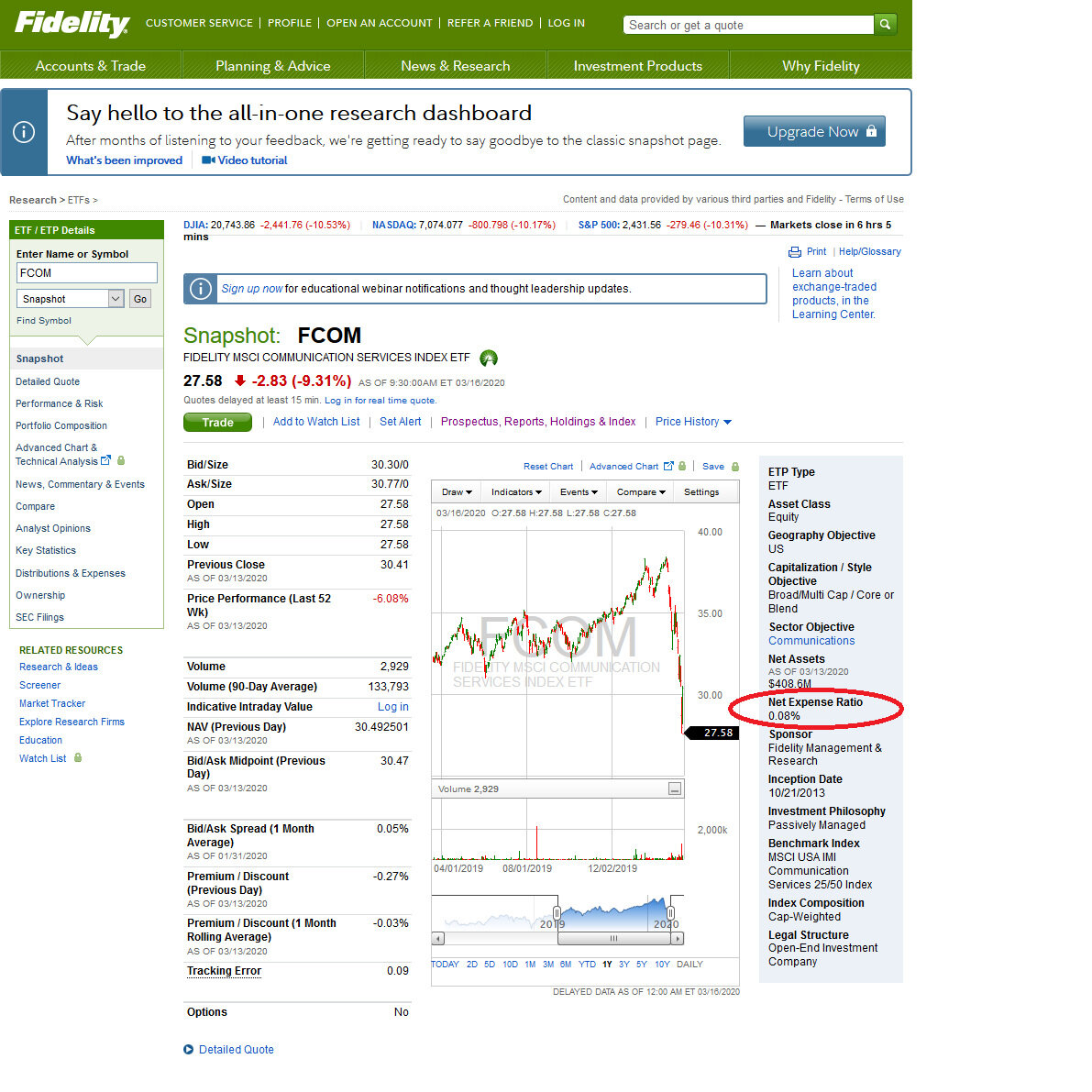

First, a caveat to be weary about touching your investment accounts. The current market is very volatile right now so be prepared when you log in to your investment accounts. If you are a long-term investor, don’t let the market fluctuations make you nervous. Stay the course! In the downtime though, take some time to review the fees on your investments. This can be easy to do by reviewing your investment documents and looking under Expense Ratio. Remember that fees can eat up your gains which means less money to use.

A tool like Personal Capital can also give you an easy way to see all of the fees across your investments. It’s a FREE tool. Here’s my full review of it if you are ready to try this route.

Catch Up on Personal Finance Reading

Now would be a great time to read a few personal finance books that’s been on your radar. Sadly, many libraries have shut down for the safety of their patrons, but it doesn’t mean you won’t have access to resources. Download your library’s online media resource such as Hoopla, Overdrive, or Libby. All you’ll need is your library card number. If you need help, contact your library (many are still providing online/phone support) and ask them how you can gain access to these FREE resources.

Here are a list of books I found for FREE via Hoopla. Grabbing them from the library means you don’t have to spend money and it will be one less item in your home. I’ve linked them to Amazon in case you want to bookmark these. I’ve personally read some of these so I recommend them.

Take an Online Personal Finance Class

Take a personal finance class without leaving your home. There are so many great videos and courses out there that provide the basics as well as advanced topics on personal finance. Taking a class and implementing some of the strategies in that class could be the single biggest opportunity you take today.

Here are some classes to consider.

BEGINNER'S GUIDE TO INVESTING by Erin Lowry (author of Broke Millinnial)

This class is only $17. $17!!! That’s crazy cheap for something that will boost your investing confidence. Not sure how long this deal will last so grab it.

START LATE, FINISH RICH by David Bach (author of 8 NYTimes best selling books)

I’ve personally taken and reviewed this class. I’m also fan girl of David Bach so this course comes highly recommended from me. It’s a few hours, but absolutely worth it’s price. See snippet below.

HOW TO MAKE MONEY by Ramit Sethi (author of I Will Teach You To Be Rich)

This class is streaming for FREE on March 18-19. Take advantage of this. Trust me, it will be worth your time.

Have The Money Talk With Your Partner

With no sports on, with many of us not having to commute, this may be the perfect opportunity to have a money talk with your partner. It’s so easy to just go about our days, passing each other, but how about we spend some time checking in on each other. See what news goals we have in mind. Sitting with your partner, talking about what you want to do with your money allows you to focus you and your money on what matters.

A few things to focus on:

Revisit your life goals. What’s changed? What do you want to pursue together? What do you want for your family’s future?

Update your wills and trusts. This is especially important if you have kids.

Get your documents in order. Make sure both partners know what’s going on with the money and where the important documents are just in case.

Celebrate your money wins. What have you paid off?

Set up a plan for your money. What do you want to do with the raise? Don’t spend it before you get it.

Conclusion

I do hope the next few weeks go by smoothly and swiftly for all of us. There is a sense of anxiety in the air that is hard to shake. Take the next few weeks as an opportunity to do something out of your normal routine. Remember that what you do today will affect your family’s financial future tomorrow so let’s use this time wisely.

7 Ways to Strengthen Your Family Finances While Under Self-Quarantine

7 Ways to Strengthen Your Family Finances While Under Self-Quarantine